Headlines

EV industry moving in right direction to close gap with internal combustion engines – report

Electric cars on parade. (Image by Dept of Energy Solar Decathlon, Flickr).

Although there is still a way to go for electric vehicles to close the performance, safety, and cost gap with internal combustion engines, a recent report by IDTechEx says some specific moves by the EV industry are steps in the right direction.

According to the report’s author, Luke Gear, one major positive trend is the increased electrification of a variety of sectors, not just automotive.

“A decade ago, IDTechEx’s 2011 report ‘bullishly’ predicted 1.5 million battery-electric car sales by 2021 – this turned out to be an underestimate by over half, as China, the US, and Europe all grew their markets last year,” Gear points out. “The sheer volumes and successes of electric vehicles in the automotive market are driving down costs, creating opportunities for many other mobility sectors.”

Boats and ships are among those experiencing an electrification boom, with electric ferry deliveries having grown to ~80MWh yearly as battery pack costs fell below $600 per kWh, energy densities improved and thermal management innovations vastly increased safety.

In the author’s view, similar drivers are pushing forward investment into electric air-taxis, as American Airlines, Virgin Atlantic, United Airlines, UPS and Avolon have all placed pre-orders.

“Electrification is not so much unstoppable as inevitable and will continue to play a dominant role in the decarbonization of mobility,” the report reads.

When it comes to batteries, the market analyst forecasts that lithium-based batteries will continue to be the great enabler for electrification, particularly if the industry expands its efforts to increase the sustainability of raw materials and supply chains whilst ensuring there is still enough supply to meet the growing demand.

“Later in the decade, a move beyond li-ion towards the holy grail of solid-state and lithium-metal batteries is critical for a step-change in safety and performance, and to open the door to new applications such as electric long-haul aircraft,” the report states.

Motors and powertrains

For Gear, another move that is expected to gain traction in the coming years is the utilization of magnet-free and even copper-free motor solutions as automakers start adopting several technologies to balance performance, sustainability, market demand, and cost.

The expert explains that due to their high performance and superior efficiency, permanent magnet motors are the default technology for traction applications and their market has naturally grown with the runaway success of electric cars. However, magnets make end-of-life recycling difficult, and raise concerns regarding price volatility and sustainable mining practices, with most material mined and sourced in China.

“Long-term reliance solely on permanent magnet machines is looking increasingly unsustainable, with warning signs starting to show in high neodymium prices – the primary ingredient of rare earth magnets.”

On a similar note, it is likely that more and more automakers will switch to wide bandgap power electronics, especially silicon carbide MOSFET devices.

IDTechEx data predict roughly half the electric car market switching to these efficient devices by 2030, thus enabling efficient high voltage powertrains.

“Early in 2022, Mercedes showcased the Vision EQXX concept capable of 1000km. While there is a lot of technology behind this concept, including solar bodywork, design (drag factor), silicon anode batteries, and axial flux motors, a key enabler is the 900V platform – something only practical with silicon carbide,” the dossier states.

Key safety features

Finally, increased attention to safety features is expected to be key in the years to come, particularly when it comes to the thermal management of electric motors and power electronics.

“Permanent magnet motors require a specific operating temperature to avoid damage. Additionally, allowing the copper coils in a motor to get too hot can lead to reduced efficiency or damage to the winding insulation,” Gear writes.

“The silicon carbide transition in power electronics is also presenting a host of package-level thermal challenges to deal with the increased junction temperatures including wire bonding, die-attach, and substrate technologies.”

In the battery realm, the analyst highlights the fact that battery chemistry is evolving with higher nickel cathodes being adopted, LFP batteries making a resurgence and more attention being paid to solid-state batteries.

“These changes have a profound impact on the requirements around thermal management and materials in EV batteries,” Gear points out. “Outside the cell, we see OEMs transitioning towards cell-to-pack designs with announcements from Tesla, Stellantis, BYD, VW and more. This fundamental change in battery pack structure leads to changes in how thermal strategies and materials are incorporated, including thermal interface materials, coolant channels and fire protection.”

David Rosenberg: Junior mining and exploration boom needed to push EVs over the top

The transition to electric vehicles will require huge investments into mining for the key resources that go into batteries

David Rosenberg

Petro Canada's electric vehicle charging station is shown on display at the Canadian International Auto Show in Toronto. PHOTO BY THE CANADIAN PRESS/CHRISTOPHER KATSAROV FILES

By David Rosenberg and Ellen Cooper

Electric vehicles are quickly becoming mainstream as government subsidies, company investments and consumer demand speed up the transition away from internal combustion engines.

But with the world electrifying, will we have enough natural resources to meet this surging demand? The answer is yes, though investments in extraction and processing will need to be ramped up and there are important environmental, social and corporate governance (ESG) considerations that will need to be addressed to make the shift sustainable.

Given current policy scenarios, the International Energy Agency (IEA) estimates the global stock of EV cars will surge to 125 million in 2030 from around 10 million in 2020. Under a sustainable development scenario (where the world reaches net-zero emissions by 2070), this figure could be more than 200 million units. This is still nowhere close to replacing the 1.3 billion vehicles on the road currently, but the future of transportation may involve more public transit and far fewer individual cars than what we see these days. Internal combustion engine (ICE) vehicles will be with us for several decades more, likely not phased out until mid-century.

The transition to EVs will require huge investments into mining for the key resources that go into batteries, namely lithium, cobalt, manganese, copper and nickel. Indeed, the IEA estimates a six-fold increase in minerals will be required by 2040 to meet net-zero targets under the Paris Agreement. This includes a 40x increase in demand for lithium, a 20-25x increase for cobalt and nickel, and a doubling in copper demand.

Whether the world has enough reserves to meet this demand is a bit of a misleading question. Reserves go up as exploration expands, prices go up (making more difficult reserves economical to exploit), technologies improve and regulations change. These kinds of “peak EV resource” predictions are reminiscent of the calls throughout the past half-century for “peak oil.” Remember, new technologies (for example, fracking in the United States and horizontal drilling techniques) unlocked reserves that were previously not economical. Nowadays, when we discuss “peak oil,” the fear isn’t that we run out of reserves, but that some reserves will become stranded assets as we transition to the electric economy.

That said, there is a simmering concern that mining companies have not made the required investments to address growing demand needs. The global mining industry will need to more than double its annual capex expenditures — from around US$80 billion annually to US$180 billion — to meet the net-zero target by 2050, according to Bank of America Global Research. And there continues to be a heavy reliance on countries such as China (rare earths) and the Democratic Republic of Congo (cobalt) where environmental and governance standards are lax. ESG concerns such as child labor, using coal to power mining activities and poor reporting standards in many key mining jurisdictions will need to be addressed and threaten production.

If the U.S. and other western countries hope to secure supplies of many of the key commodities required for the energy transition ahead, they will need to rely on friendlier partners such as Australia, Chile, India and Brazil that have significant reserves of rare earths, lithium and cobalt. This is yet another argument for closer ties with India. The country is home to six per cent of global rare earth deposits, but its production is an underwhelming 1.4 per cent, meaning there are opportunities to engage in resource diplomacy with the country in an effort to counter China and Russia’s commodity dominance.

Strengthening supply is critical. We have all become abundantly aware of how disruptive supply chains can become when they experience major shocks.

Given the concern around supply chains, some of this development will be done closer to home. The U.S., for example, released its National Blueprint for Lithium Batteries in June, which included five goals for the domestic lithium-ion battery supply chain, and the No. 1 goal was securing access to raw materials domestically (where possible). Part of that also means investing in research and development to find ways to decrease demand for cobalt and nickel. Innovations in EV battery technology to remove cobalt are underway, which could shift the composition of resource demand over time. Other key goals are to support U.S.-based materials processing, develop a manufacturing sector able to produce electrodes and cells, and, finally, enable mass recycling of EV battery cells (the European Union has already put in place recycling standards in this regard).

Ultimately, as governments globally invest in better charging infrastructure and the world reaches a critical mass of adoption, ICE-age vehicles will be phased out at an increasing rate, meaning mining will have to keep up to match demand. This means a junior mining and exploration boom is coming, with bullish implications for mining and infrastructure stocks and supercycle EV commodities such as lithium, manganese, cobalt and nickel.

David Rosenberg is founder of independent research firm Rosenberg Research & Associates Inc. Ellen Cooper is a senior economist there. You can sign up for a free, one-month trial on Rosenberg’s website .

The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition

As the world gears up for net zero, demand for raw materials is set to soar. The energy transition presents unique challenges for metals and mining companies, which will need to innovate and rebuild their growth agenda.

The transition to a net-zero economy will be metal-intensive. As the move toward cleaner technologies progresses, the metals and mining sector will be put to the test: it will need to provide the vast quantities of raw materials required for the energy transition. Because metals and mining is a long lead-time, highly capital-intensive sector, price fly-ups and bottlenecks will be unavoidable as demand outstrips supply and price volatility creates uncertainty around the large up-front capital investments needed for production. Supply, demand, and pricing interplays will emerge across different commodities, leading to feedback loops followed by a combination of technology shifts, demand destruction, and materials substitution. Metals and mining companies will be expected to grow faster—and more cleanly—than ever before. At the same time, end-user sectors will need to factor potential resource constraints into technology development and growth plans.

-

This article is a collaborative effort by Marcelo Azevedo, Magdalena Baczynska, Patricia Bingoto, Greg Callaway, Ken Hoffman, and Oliver Ramsbottom, representing views from McKinsey’s Metals & Mining Practice.

By the end of the November 2021 United Nations Climate Change Conference (COP26), it became clear that momentum had shifted. Climate commitments made in Glasgow have entrenched the net-zero target of reducing global carbon emissions (aimed at preventing the planet from warming by more than 1.5°C) as a core principle for business. At the same time, another reality became apparent: net-zero commitments are outpacing the formation of supply chains, market mechanisms, financing models, and other solutions and structures needed to smooth the world’s decarbonization pathway. Even as debate continues over whether the conference achieved enough, it is evident that the coming decade will be decisive for decarbonizing the economy. While every sector in the global economy faces common pressures—such as stakeholder and investor demands to decarbonize their own operations—metals and mining companies have been presented with a special challenge of their own: supplying the critical inputs needed to drive the massive technological transition ahead.

Raw materials will be at the center of decarbonization efforts and electrification of the economy as we move from fossil fuels to wind and solar power generation, battery- and fuel-cell-based electric vehicles (EVs), and hydrogen production. Just as there are several possible trajectories through which the global economy can achieve its target of limiting warming to 1.5°C, there are corresponding technology mixes involving different raw-materials combinations that bring their own respective implications. No matter which decarbonization pathway we follow, there will be fundamental demand shifts—and these will change the metals and mining sector as we know it, creating new sources of value while shrinking others.

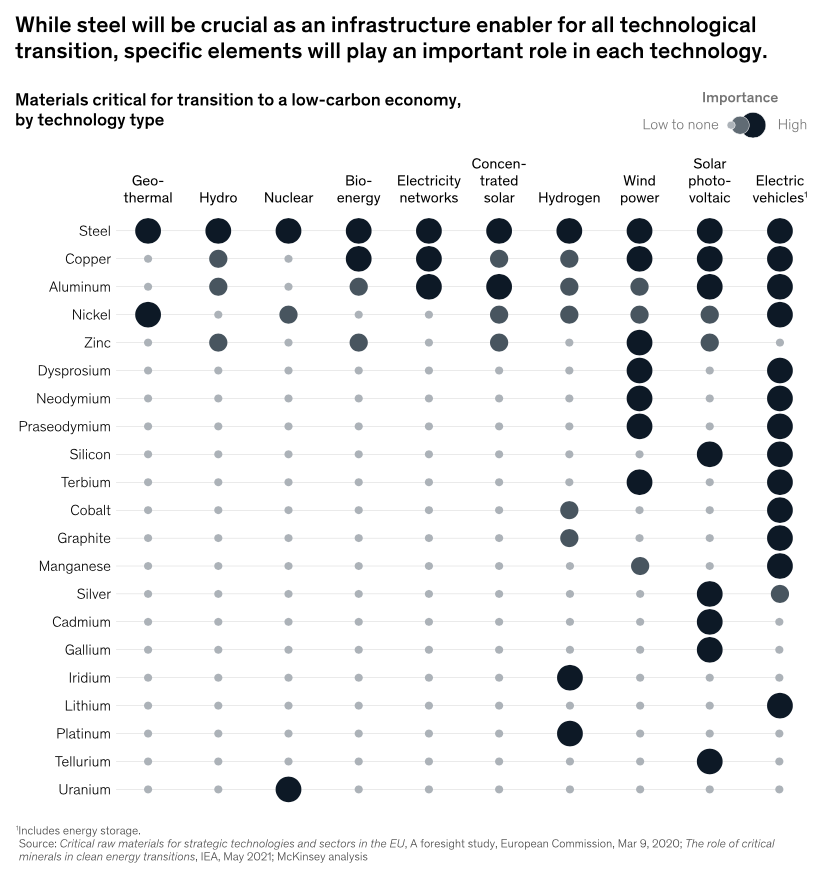

Requirements for additional supply will come not only from relatively large-volume raw materials—for example, copper for electrification and nickel for battery EVs, which are expected to see significant demand growth beyond their current applications—but also from relatively niche commodities, such as lithium and cobalt for batteries, tellurium for solar panels, and neodymium for the permanent magnets used both in wind power generation and EVs (Exhibit 1). Some commodities—most notably, steel—will also play an enabling role across technologies requiring additional infrastructure.

Exhibit 1

-

Rare-earth metals’ existing global reserves (in aggregate across different metals) are believed to be 120 million metric tons of rare-earth-oxide (REO) equivalent, representing 500 years equivalent of the global estimated production of 240,000 metric tons in 2020.1 However, when looking closer, a number of factors stand out. First, these elements occur in relatively low concentrations; therefore, identifying and bringing assets to production would likely come with higher investment needs and lead times. Second, specific elements (for example, neodymium), which are critical for the transition, occur at very different proportions within those deposits. This makes the availability and economics of specific metals much more nuanced than a superficial analysis can reveal. Third, there is a significant geographical concentration of known reserves: 40 percent of REO-equivalent reserves are estimated to be in China. Therefore, additional geological exploration would be needed to identify other economically viable deposits in specific geographies. Finally, in addition to the availability of raw materials, processing and separation of the specific elements is crucial. To date, most of the processing and separation capacity, as well as the technical capabilities, are also concentrated in China. Energy transition will therefore require a regional redistribution of processing capacity and reorganization of supply chains.

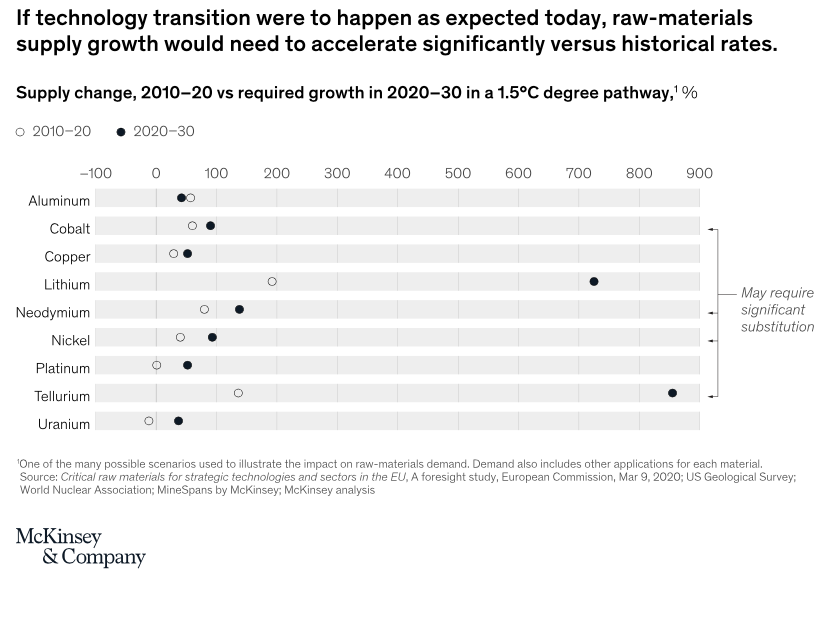

The required pace of transition means that the availability of certain raw materials will need to be scaled up within a relatively short time scale—and, in certain cases, at volumes ten times or more than the current market size—to prevent shortages and keep new-technology costs competitive (see sidebar “Rare-earth metals”).

Economic growth, technology development, and material intensity as drivers of demand growth

-

Tellurium, a relatively niche metal used in certain types of solar panels, has a global mine production of approximately 500 metric tons.1 A tellurium-only mine does not exist, as it is exclusively produced in small quantities as a by-product of the smelting and refining of other metals (more than 90 percent of tellurium is produced from anode slimes collected from electrolytic copper refining2 ). As such, while demand growth driven by solar capacity may be prodigious, growth in supply is expected to be capped at the growth rates of metals such as copper. Even though copper demand is also expected to experience significant growth due to the energy transition, its mine supply is unlikely to expand at the rates that solar-panel production needs in a net-zero-transition scenario.

Road-transport and power-generation are examples of sectors that are relatively advanced with respect to their technological readiness to reduce greenhouse-gas (GHG) emissions. But building a low-carbon economy and reducing the emissions intensity within these sectors will be materials-intensive (Exhibit 2). For example, generating one terawatt-hour1 of electricity from solar and wind could consume, respectively, 300 percent and 200 percent more metals2 than generating the same number of terawatt-hours from a gas-fired power plant, on a copper-equivalent basis,3 while still drastically reducing the emissions intensity of the sector—even when accounting for the emissions related to the materials production.4 (See sidebar “Mine supply and solar-panel production” for more on how supply of an essential raw material is currently limited.) Similarly, producing battery or fuel-cell EVs will be more materials-intensive than building an internal combustion engine (ICE) vehicle.

Exhibit 2

When building new power-generation capacity or producing new vehicles, factors other than material intensity also influence each technology’s carbon footprint.5 First, there are the emissions derived from use of the technology throughout its life cycle (such as the burning of fossil fuels in power generation, or the use of electricity in running a battery EV). Second, the emission intensity of each technology will depend, to a certain extent, on the choice of material (for example, steel versus aluminum in the case of vehicles). Third, even when using the same material, choice of supplier can make a significant difference, since the carbon footprint of the same commodity can vary greatly depending on its origin. Finally, each sector will have its own specificities. In the case of power generation, renewable capacity has lower capacity factors than fossil-fuel-based capacity. As such, more generation capacity and, hence, more metals are needed to generate the same amount of electricity. In the case of road transport, the average mileage of different powertrains could also play a role (for example, if battery EVs and fuel-cell EVs were to be driven for longer distances over their lifetimes compared with ICEs).

How quickly can supply react?

Looking ahead, under a scenario in which materials are required at steadily growing levels to meet evolving needs but markets fail to adapt to varying technology mixes6 and materials intensities over time, hypothetical shortages of raw materials would emerge—as demand is expected to grow significantly faster than supply. Under the scenario presented in Exhibit 3, lithium mine supply, for example, would need to grow by around a factor of seven versus today’s required growth. Meanwhile, metals with smaller mine supply (such as tellurium) would need to show even faster growth—as such, these are the main candidates for required substitution and technological innovation. Other metals, such as copper and nickel, would also need to see accelerated supply growth compared with what has been observed in the past. While the required growth in such metals may seem less ambitious, this should be considered relative to the significantly larger-scale industries surrounding them, as well as the significant capital required, increasingly challenging geological conditions (such as smaller deposits and lower grades), long lead times, and growing processing complexity involved. For copper and nickel alone, we estimate that meeting demand growth of the order of magnitude shown in Exhibit 3 would require $250 billion to $350 billion cumulative capital expenditures by 2030, both to grow and replace depletion of existing capacity. Despite a relatively large pipeline of projects to scale up supply in some of these commodities, and efforts to reduce the capital and operating costs associated with a number of them (such as direct lithium extraction), the task at hand is not trivial. In fact, in the scenario presented in Exhibit 3, we could see copper and nickel demand exceeding supply by five to eight million and 700,000 to one million metric tons, respectively. As such, incentives for new supply growth will be necessary.

Exhibit 3

Price incentives

-

Nickel, which is used in battery production, is widely available in the earth’s crust. However, it is subject to a number of commodity-specific factors. First, while battery-suitable nickel (that is, class 1 nickel) can be produced from the various deposit types (sulfides, laterites), relatively long lead times of ten years or more from discovery to feasibility, construction, and ramp-up, along with the high capital intensity of greenfield assets, could lead to short-term deficits. Second, nickel is a relatively established market, but it is primarily used in stainless-steel production (around two-thirds of the global nickel supply was used in stainless-steel production in 2020). The fast growth in nickel demand from batteries, therefore, may potentially lead to a fly-up in prices and require large-scale substitution and technological innovation to rebalance the market—either in batteries themselves, forcing a move to different battery chemistries, or in established markets such as stainless steel, driving a shift in stainless-steel-series production, or both—unless capacity starts to rise quickly, combined with conversion of lower-grade class 2 nickel into class 1 nickel.

Thus, while there may not necessarily be physical resource scarcity for some of these raw materials in the earth’s crust, and acknowledging that recycled materials will play an increasingly important role in decarbonization in the future, the trajectory toward materials availability will not be a linear one. We expect materials shortages, price fly-ups, and, given the inability of supply to react quickly, the need for technological innovation and substitution of certain metals (possibly at the expense of performance and cost of the end-use application). While raw-materials needs will grow exponentially for certain metals, lead times for large-scale new greenfield assets are long (seven to ten years) and will require significant capital investment before actual demand and price incentives are seen. At the same time, with increasingly complex (and largely lower-quality) deposits needed, miners will require significant incentive (for example, consistent copper prices of more than $8,000 to $10,000 per metric ton and nickel prices of more than $18,000 per metric ton) before large capital decisions are made (see sidebar “Nickel and battery production”). Without slack in the system (such as strategic stockpiles and overcapacity), the industry will not be able to absorb short-term (less than five to seven years) exponential growth. As seen, for example, with past reduction of cobalt intensity in batteries, a combination of technological development on the supply side and large-scale substitution and technological development on the demand side will occur. Substitution in noncritical applications will take place and new extraction and processing technologies will emerge. An individual sector’s ability to rapidly ramp up supply, as well as other factors such as continued technological development and performance, available material alternatives and carbon-footprint implications for end-use applications, to name a few, could all impact the extent of substitution for individual commodities. Hence, we see commodities such as tellurium, with its small volumes and by-product nature, likely requiring substitution, while lithium, despite the fast expected growth, perhaps not as much, given the relatively large pipeline of projects and continued development of new production technologies.

How market balance is achieved

Despite the potential for shortages, as discussed above, supply will always equal demand. As sectors and countries decarbonize, each individual commodity market will face specific supply-and-demand balances. The resulting picture will not mirror any specific forecasted commodity demand, including the scenario outlined in Exhibit 3, but what we will see is a constant feedback loop between supply, demand, and prices. We believe that commodities facing an upside in demand from the energy transition will follow one of three trajectories, as demand accelerates (Exhibit 4):

Supply responds to prices. As demand accelerates and prices react, the industry is able to bring in new supply (for example, lithium) relatively quickly. In such cases, the technological transition follows the “expected” growth, where the commodity does not become a structural bottleneck, even if there is short-term volatility.

Demand accelerates, prices react strongly, and materials substitution kicks in. The industry is unable to bring in new supply fast enough and technological innovation leads to materials substitution within that application (for instance, cobalt after a price spike). In such cases, performance of the technology deployed may be compromised, with implications for overall needs, for example, lithium iron phosphate (LFP) batteries being less energy dense than NMC7 batteries.

Demand accelerates, prices react strongly, and technology substitution kicks in. In this case, rather than materials substitution within the application, the end-user sector is forced to shift its technology mix. In such a scenario, a different bottleneck may emerge. For example, non-tellurium-based solar panels may have lower performance, which may lead to a shift toward more wind-generated power, adding pressure on neodymium.

Exhibit 4

We have observed the second trajectory within the battery sector, where there are three very distinct phases in the feedback loop. Initially, batteries with a relatively high cobalt content were common. As adoption began to accelerate, and cobalt prices reached $100,000 per metric ton in 2018, batteries with cathodes containing more nickel started gaining share. This substitution was in the end seen as a win–win result for the industry, leading to lower battery costs and higher energy density.

Subsequently, as high-nickel-containing batteries started becoming more common, the industry began to realize the scale of the task ahead: a large growth in class 1 nickel demand in an industry that has faced capital-expenditure overruns, delays, and in several cases, failure to reach design capacity. Nickel prices also started going up as consumers tried to secure supply.

Today, battery producers and OEMs speak about optionality, with a tiered approach to battery technology. LFP batteries have started gaining share again, while high-manganese-content batteries are also expected to be developed. Manganese is a compelling alternative, as its global production of approximately 20 million metric tons8 is four to five times greater than nickel production and 140 times greater than cobalt production. Meanwhile, manganese reserves of 1.3 billion metric tons are 16 times greater than reserves of nickel and 140 times greater than reserves of cobalt.9

This cycle is likely to keep evolving, as battery technology moves ahead, adoption accelerates, and possible new bottlenecks arise. And as other sectors make the energy transition, individual commodity sectors’ ability to ramp up quickly will be put to the test. With power generation, a similar cycle could follow, for example, with tellurium and silver potentially becoming a bottleneck for production of solar panels; with neodymium and praseodymium, for the rare-earth-based permanent magnets used in wind power generation; and potentially even with the extra uranium needed for additional nuclear-generation capacity.

Implications for producers and end-user sectors

The energy transition will force every sector of the economy to adapt, each with its own specific challenges.

As the raw-materials supplier to the economy, the mining sector will need to grow at an unprecedented pace in order to enable the required technological shifts. The sector will be expected to move at a faster pace, despite its traditional reputation as a long lead-time, highly capital-intensive industry. As metals will undoubtedly play a crucial role in keeping the planet within a 1.5°C warming scenario, producers of metals commodities will need to undertake the following:

(Re)build a growth agenda. In the context of shifting commodity value pools and rebalancing portfolios, the mining sector has underinvested for several years—an issue accentuated in 2020 by the COVID-19 pandemic. With the expected demand growth ahead, miners will need to rebuild their growth portfolios. This can take multiple forms, from grass-roots exploration to selective M&A and creating exposure to recycling. The sector’s financial health has improved significantly since 2015, with lowering debt-to-equity ratios and significant cash generation, although balance-sheet health will remain a key priority for most boards and executive teams, given the sectors’ cyclicality.

Innovate for productivity and decarbonization of operations. Technological innovation will be an important lever both to enable debottlenecking and growth (for example, advanced analytics in mining and processing) and to facilitate reduction of the carbon footprint in operations (for example, fleet electrification, water management).

Embed themselves into supply chains. Due to both the specific requirements of a number of decarbonizing technologies and the strict emission-footprint-reduction targets from end-user sectors, a number of metals will become less commoditized. Just as procurement by end-user sectors will change, so will the marketing and sales of metals. Understanding customers’ product specifications and requirements and partnering with consumers will be key, as will capturing quality and green premiums in the context of tightening supply–demand balances. In addition to placing volume on the market, this lever will help to manage downstream Scope 3 emissions from raw-material producers.

At the same time, consumers of raw materials will need to factor potential resource constraints into technology development and growth plans. The following solutions are on the table for consideration:

Adapt technology rollout plans. In response to raw-materials price volatility and supply constraints, companies will need to identify and distinguish between hard and soft constraints around technology rollout—and then engineer raw materials that may be difficult or expensive to source.

Send clear demand signals and secure raw-material supply. Clearly signaling growth, technology mix, and material needs will be an important mechanism to enable raw-material suppliers to approve large capital investments. This will take place (and is already doing so) in multiple forms: from off-take agreements with producers and partnerships with raw-materials suppliers to equity ownership of raw-material production. Irrespective of the strategy used, companies along the supply chain, such as cathode-active material producers, EV OEMs, and battery producers, will need to secure raw materials to enable aggressive growth plans, while also decarbonizing their own supply chains.

ABOUT THE AUTHOR(S)

Marcelo Azevedo is an associate partner in McKinsey’s London office, Magdalena Baczynska is a research science analyst in the Wroclaw office, Patricia Bingoto is a senior knowledge expert in the Zurich office, Greg Callaway is a consultant in the Johannesburg office, Ken Hoffman is a senior expert in the New York office, and Oliver Ramsbottom is a partner in the Hong Kong office.

The authors wish to thank Jochen Berbner, Nicolò Campagnol, Julian Conzade, Stephan Görner, Michael Guggenheimer, Benoît Petre, Humayun Tai, and Michel Van Hoey for their contributions to this article.

Rushing headlong into electrification, the West is replacing one energy master with another

The United States and its allies, such as Canada, the UK, the European Union, Australia, Japan and South Korea, face a dilemma when it comes to the global electrification of the transportation system and the switch from fossil fuels to cleaner forms of energy.

On the one hand, we want everything to be clean, green and non-polluting, with COP26-inspired goals of achieving net zero carbon emissions by 2050; and several countries aiming to close the chapter on fossil-fuel-powered vehicles, including the United States which is seeking to make half of the country’s auto fleet electric by 2030.

Yet many of these same countries are continuing to go flat-out in their production of oil and natural gas — considered a bridge fuel between fossil fuels and renewables, wrongly imo, for environmental reasons — a/ because they want to be energy-independent; and b/ because they have to. Germany is a good example of a country that tried to switch too soon to renewable energy, retiring its nuclear and coal power plants, only to find that the wind and sun didn’t produce enough electricity. Germany is now having to rely on Russian natural gas and the burning of lignite coal to keep the lights on and homes/ businesses heated throughout the winter.

We all remember (well those that are old enough do) the long gas station lineups of the 1970s during the OPEC oil embargo. At that time, the US was almost 100% dependent on Saudi Arabia and other Gulf states for its crude oil.

Well times have changed and the US is supposedly energy-independent — in September 2019 the United States exported 89,000 barrels per day more petroleum (crude oil and petroleum products) than it imported, the first month this happened since monthly records began in 1973.

Now the materials required for a modern economy are those needed for electrification and decarbonization — metals like lithium, graphite, nickel and cobalt for EV batteries; copper for wiring, motors and charging stations, as well as renewable energy systems; silver for solar cells, and rare earths like neodymium for wind turbines.

The problem is, getting to 100% renewables, if that is even possible (I’d say more like 40%, if we’re lucky) will require more metals than are currently available in the world’s mines. Shortages are forecasted by 2030 for cobalt, copper, lithium, natural graphite, nickel and rare earths. Moreover, getting those minerals in the amounts demanded means going to some environmentally unfriendly places, including Indonesia for sulfide nickel, the DRC for cobalt, and China for rare earths.

The irony is, the rush to “go green” carries with it the simple fact that the mining of this stuff is anything but. Yet because Western countries like Canada and the US haven’t bothered to develop their own mine to electric vehicle, or mine to renewable energy plant supply chains, they are dependent on imports. EVs and solar/wind sound green, but how green are they when the materials are being imported from places like Indonesia, which allows tailings to be dumped into the sea, and the extremely polluting HPAL method of separating laterite nickel into the end product used in batteries?

It all comes down to security of supply. Western countries don’t have it, because they haven’t bothered to mine, or refine, domestically and continue to rely on imports especially from China but also South Africa and Russia.

And we can’t forget fossil fuel dependency because many countries cannot, and will not, build the infrastructure needed to decarbonize/ electrify.

They will continue to require huge amounts of coal, oil and natural gas. Even Europe, supposedly on the leading edge of “green”, relies heavily on Russian gas, as we shall see below. Japan, which has no natural resources of its own, in 2020 imported the majority of its oil from Saudi Arabia. And Australia, despite being a mining powerhouse (coal, iron ore), will by 2030 be 100% reliant on imported petroleum, due to the ongoing closure of its refineries.

Our addiction to oil means that hybrid vehicles, obviously requiring gasoline, are expected to continue outpacing full electrics for years.

When it comes to energy, we have in effect replaced one master, Saudi Arabia which ruled the global oil markets for decades, with China, which “owns” the EV supply chain. And despite eco-dreams of killing off fossil fuels, they remain very much in the picture, with Russia lording power over European gas imports, for example, and Japan and Canada continuing to rely heavily on Middle Eastern oil.

Even if we wanted to reduce our dependence on these countries, the mining industry faces significant local opposition to mineral exploration, mining, processing and smelting. Ironically, the greens who require all these minerals, to go electric, are the same people opposing their extraction.

Carmakers plugging in

It all starts with demand.

Global automakers have latched onto the electrification trend and are going great guns to deliver new models to a reticent public getting keener on plug-ins.

While Tesla dominated the early days of electric vehicles, Elon Musk’s baby is in the cross-hairs of Volkswagen and Toyota, who are reportedly planning on spending $170 billion to knock Tesla off its perch.

“When the two biggest car companies in the world decide to go all-in on electric, then there’s no longer a question of speculation — the mainstream is going electric,” Bloomberg quoted Andy Palmer, the former chief of Aston Martin and ex-Nissan Motor Co. executive, in a recent story.

In early December, VW CEO Herbert Diess announced $100 billion will be going into EV and software development over the next decade. The iconic German company already has the Audi e-tron and the Porsche Taycan, and last year came out with two new offerings, the ID.3 hatchback and ID.4, an SUV. The MEB platform underpins 27 EV models Volkswagen sported at the end of 2021. The number of factories they will be built in has been increased from five to eight, including VW’s US assembly plant in Chattanooga, Tennessee.

Facing criticism for being late to the space, Toyota has stepped up its EV game. (while the Japanese company is known for its trail-brazing Prius hybrid, Toyota’s first mass-market global EV isn’t set to debut until the middle of this year)

Of the $70 billion Toyota is dedicating to electrification by the end of this decade, half will go to fully electric models, Bloomberg reports. The carmaker plans to sell 3.5 million EVs a year by 2030, almost double its earlier target.

A couple of months ago Akio Toyoda, grandson of the company’s founder, made headlines for introducing a Corolla Sport H2 Concept vehicle with a hydrogen-fueled engine. Following a spin around a racetrack, Toyoda announced plans to come out with 30 new EV models within the next eight years.

This week GM unveiled its new electric Chevrolet Silverado pickup, as buzz grows for the truck’s future rival, the Ford F-150 Lightning, set to go on sale this spring.

Top dog Tesla, meanwhile, is aware of the competition nipping at its heels. Last year the California-based firm nearly doubled its production, delivering over 936,000 vehicles. $188 billion is being plowed into its Shanghai plant to take production beyond its 450,000 units a year capacity, with Tesla’s two new assembly plants, one in Germany and one in Austin, TX, gearing up to start making Model Ys, Bloomberg reports.

All the big carmakers all try to out-do one another in bringing out new electric-vehicle models, yet arguably, they are getting ahead of themselves. There are still major obstacles to greater EV penetration, the main ones being sticker shock, limited range, charging station availability, and charge times. While it might make sense for urban dwellers to run EVs to and from work and charge them at home, residents living in rural areas or in cold winter climates may find electrics inappropriate, even dangerous, say if they are caught in a traffic jam in freezing temperatures.

Then there is the problem of raw materials supply — being able to find the minerals and metals needed, and to mine them responsibly and sustainably.

The EV “revolution” has also glossed over a very important point: going green comes with a cost — energy security.

We tackle each of these topics in turn.

We don’t have the metals

The adage “if it can’t be grown it must be mined” serves as a reminder that electric vehicles, transitional energy, and a green economy start with metals. The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a green economy — starts with metals and mining.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

Commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

Transportation makes up 28% of global emissions, so transitioning from gas-powered cars and trucks to plug-in vehicles is an important part of the plan to wean ourselves off fossil fuels.

Kozak and O’Keefe forecast EVs will make up about 15% of new car sales by 2025, doubling to 30%, or 30 million EVs, by 2030.

A green infrastructure and transportation spending push will mean a lot more metals will need to be mined, including lithium, nickel, and graphite for EV batteries; copper for electric vehicle wiring and renewable energy projects; silver for solar panels; rare earths for permanent magnets that go into EV motors and wind turbines; and silver/ tin for the hundreds of millions of solder points necessary in making the new electrified economy a reality.

In fact, battery/ energy metals demand is moving at such a break-neck speed, that supply will be extremely challenged to keep up. Without a major push by producers and junior miners to find and develop new mineral deposits, glaring supply deficits are going to beset the industry for some time.

According to a report by UBS, a deficit in nickel will come into play this year, for rare earths in 2022, for cobalt in 2023, and in 2024, for lithium and natural graphite.

Moreover, the Swiss investment bank predicts large deficits by 2030 for each of these metals: 170,000 tonnes for cobalt, equal to 42% of the cobalt market; 10.9 million tonnes of copper (about half of current global mined production), representing 31% of the market; 2.1Mt for lithium (50% market share); 3.7Mt for natural graphite and 2.2Mt for nickel (both 37%); and 48,000 tonnes for rare earths, equivalent to 47% of the market.

In a thought experiment, we at AOTH crunched the numbers for what it would take to get to 100% renewables. The amount of raw materials required is “off the charts”.

Wind and solar energy do not happen without mining, and they take unbelievable amounts of metals. Just replacing the current amount of energy demanded by coal and natural gas, let alone inevitably higher figures in future, with solar and wind, we calculated it would take over 60,000 solar farms and more than 120,000 wind farms. In all it’s about a 450% increase in renewables.

Ain’t gonna happen, folks. We will run out of metals long before we reach that level of renewable energy capacity. In fact we would be surprised if we even make it to 40%. Without a concerted and global push to mine more, the prices of the required metals will keep climbing, crimping demand for them.

We already know that we don’t have enough copper for more than a 30% market penetration by electric vehicles. For solar power we are talking about finding 16 times the current annual production of aluminum, and 23 times the current global output of copper. Up to six times the current production levels of nickel, dysprosium and tellurium are expected to be required for building clean-tech machinery.

Even if the mining industry could identify and produce this amount of metals to meet the world’s goal of 100% decarbonization, the supply shortages guaranteed to hit the markets for each would make them prohibitively expensive. It’s just supply and demand.

Something nobody in the clean-tech, green-energy space likes to talk about is the “dark side of green”. This can be seen as a hidden cost of electrification/ decarbonization.

In Indonesia, nickel is produced from laterite ores using the environmentally damaging HPAL technique. The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL employs sulfuric acid, and it comes with the cost, environmental impact and hassle of disposing the magnesium sulfate effluent waste. The Indonesian government only recently banned the practice of dumping tailings into the ocean for new smelting operations, and it isn’t yet a permanent ban.

Chinese nickel pig iron producers in Indonesia now are looking to make nickel matte, from which to turn laterite nickel into battery-grade nickel for EVs. The process however is highly energy-intensive and polluting, as well as far more costly than a nickel sulfide operation (up to $5,000 per tonne more). According to consultancy Wood Mackenzie, the extra pyrometallurgical step required to make battery-grade nickel from matte will add to the energy intensity of nickel pig iron (NPI) production, which is already the highest in the nickel industry. We are talking 40 to 90 tonnes of CO2 equivalent per tonne of nickel for NPI, versus under 40 CO2e/t for HPAL and less than 10 CO2e/t for traditional nickel sulfide processing.

What’s the point of making supposedly “green” battery components when the refining process is so dirty?

The mining industry may have achieved progress in recent years regarding environmental, social and governance (ESG), the new corporate buzz word, but in parts of the (mostly) developing world, the industry is still sporting a black eye.

Mining practices in the Democratic Republic of Congo (DRC) have elevated the issue of “conflict minerals” to the public consciousness, with stories of armed groups operating cobalt mines dependent on child labor, as well as in Guinea, where riots have broken out over bauxite mining.

Rare earths mining and processing in China, the extraction and refining of laterite nickel in Indonesia, and cobalt mining in the Congo, are three good examples of the disconnect between the rhetoric being delivered lately regarding the so-called new green economy, and reality.

In many respects the widely touted transition from fossil fuels to renewable energies, and the global electrification of the transportation system, are not clean, green, renewable or sustainable.

Ok. Enough about the mounting costs of electrification/ decarbonization and the pending shortages of metals.

There is a more immediate problem that decarbonization has brought about, and that is high electricity costs.

The cost of electrification/ decarbonization

To put it bluntly, ridding the planet of fossil fuel-generated power — coal, oil, and natural gas — is untenable. Not only are solar and wind inappropriate for base-load power, because their energy is intermittent, and must be stored in massive quantities, using battery technology that is still in development, they don’t have anywhere near the energy intensity provided by fossil fuels, or nuclear.

Driven by the need to decarbonize due to increasingly apparent climate change, governments around the world right now are choosing to de-invest from oil and gas, and instead are plowing funds into renewable energies even though they aren’t yet ready to take the place of standard fossil-fueled baseload power, i.e., coal and natural gas.

We have seen this foolish endeavor playing out in Europe, where natural gas prices are hitting records due to coal plants being shut down as well as nuclear plants shelved, such as in Germany and France. The skyrocketing cost of electricity is being borne by ordinary citizens who had no part in this dumb policy of “premature decarbonization”.

EU natural gas prices. Source: Trading Economics

Saudi Arabia has warned that, without re-investing in the oil industry to find more deposits, the world could be short 30 million barrels a day in just eight years.

In the current under-supplied environment, high oil and natural gas prices will be with us for the foreseeable future.

(High natural gas prices are impacting food prices. Food inflation is being driven by record-high fertilizer prices and climate change. Higher input prices are usually passed onto the buyer of meat, fruits and vegetables, for the rancher/ grower to preserve his profit margin.

The fertilizer market has been pummeled due to extreme weather, plant shutdowns and rising energy costs — in particular natural gas, the main feedstock for nitrogen fertilizer.

Modern farming simply cannot do without fertilizer; its higher cost must be borne by producers and so higher food prices are likely going to be “baked in” for several years. Everyone from ranchers to farmers, greenhouse growers and orchardists will be affected.)

US food inflation. Source: Trading Economics

Oil, gas & hybrids

What happened in Europe is important for resource investors to understand, because it could exemplify what is coming to North America, if we continue this mad dash to decarbonize without respecting our ongoing dependence on oil and gas.

NDTV lays it out nicely in an article titled, ‘Europe Sleepwalked Into an Energy Crisis That Could Last Years’.

Starting with the observation that its natural gas stockpiles are running dangerously low, the article points out that Europe was blindsided by an energy crunch because it was unprepared.

“The energy crisis hit the bloc when security of supply was not on the menu of EU policymakers,” says Maximo Miccinilli, head of energy and climate at consultants FleishmanHillard EU.

Europe’s natural gas production has been declining for years, leaving it reliant on imports. Yet even after an especially cold 2020-21 winter diminished natural gas supplies, Europe’s leaders didn’t lift a finger in response. NDTV explains:

Still, Europe’s leaders betrayed no alarm. On July 14, the European Commission unveiled the world’s most ambitious package to eliminate fossil fuels in a bid to avert the worst consequences of climate change. With their eyes trained on longer-term goals, such as reducing greenhouse gas emissions at least 55% by 2030 from 1990 levels, the politicians did not sufficiently appreciate some of the potential pitfalls that lay immediately ahead on the road to decarbonization…

A recent bump in LNG imports from the U.S. has provided some relief, but it’s temporary at best. France needs to take several of its reactors offline for maintenance and repairs, resulting in a 30% reduction in nuclear capacity in early January, while Germany is moving ahead with plans to shut down all of its nuclear plants. With the two coldest months of winter still ahead, the fear is that Europe may run out of gas…

Traders are already preparing for the worst, with prices for gas delivered from spring through 2023 surging about 40% over the past month. Some say the crunch could last until 2025, when the next wave of LNG projects in the U.S. starts supplying the world market.

The world’s continued dependence on oil and gas is reflected in the importance of hybrid vehicles going forward. IHS Markit notes that hybrids are projected to outpace electric cars for years. This is in large part due to car buyers’ preference for the convenience of gasoline fuel, no need to charge the vehicle, and the lower cost of a hybrid compared to an all-electric.

We also see it in the crude oil import statistics of the United States and its allies.

Canada

Despite having the world’s third-largest oil reserves, more than half of the oil used in Quebec and Atlantic Canada is imported from foreign sources including the US, Saudi Arabia, Russia, United Kingdom, Azerbaijan, Nigeria and Ivory Coast. In 2019, Canada spent $18.9 billion to import more than 660,000 barrels of oil, according to the Canadian Association of Petroleum Producers (CAPP).

Source: CAPP

United States

For decades the United States imported more oil than it exported. It wasn’t until 2019 that US net imports of crude oil and finished products flipped from negative to positive, making the country energy-independent. That year, US oil production reached a record 12.2 million barrels per day. However in May 2020, the States was back to being a net oil importer, and it has oscillated since.

According to the Energy Information Administration (EIA), in 2005, U.S. refineries relied heavily on foreign crude oil, importing a record volume of more than 10.1 million barrels per day (b/d). About 60% of the imported crude oil came from four countries: Canada, Mexico, Saudi Arabia, and Venezuela, and each was responsible for between 12% and 16% of total U.S. crude oil imports that year. By 2019, U.S. crude oil import trading patterns had changed significantly. In total, U.S. crude oil imports have fallen sharply, but imports from Canada have risen steadily to 3.8 million b/d, more than twice the imports from Canada in 2005.

The EIA chart below shows the United States gradually loosening the grip Saudi Arabia had on its oil imports — going from about 2.3 million barrels a day in 2005, to just 500,000 currently.

Source: EIA

Exactly one year ago the US didn’t import any Saudi crude for the first time in 35 years. Bloomberg notes that 12 years prior, American refiners were routinely importing about 1 million barrels a day, the second-largest supplier to the U.S. after Canada and seen as a major security risk.

How did the US become energy-independent? It began hydraulic fracturing tight shale oil fields like the Permian, Eagle Ford, Marcellus and Bakken. Fracking may have pushed US oil production to a situation of energy independence, but it came at a huge environmental cost. Pumping a toxic mix of chemicals and proppants to liberate oil and gas from tightly packed rock layers requires huge amounts of water and has been known to seep into and pollute groundwater. Fracking also releases methane, a greenhouse gas 84 times more powerful than carbon dioxide, with research indicating the US oil and gas industry emits 13 million tonnes of methane annually.

In sum, the the holy grail of US energy independence has only been achieved by sacrificing the environment; air and water pollution not only costs money, but the health of people and animals living next to wells, and sometimes, their lives.

European Union

We’ve already mentioned the energy crisis in Europe brought about by prematurely closing nuclear and coal power plants, leaving the continent dependent on Russian natural gas.

In 2019 the EU produced 39% of its own energy, and imported 61%. According to Eurostat, petroleum products comprise the majority of available energy sources (36% crude oil, 22% natural gas), with renewables representing 15% of the total, and nuclear and solid fossil fuels both 13%.

The Canadian Energy Centre recently put out a very interesting paper documenting the EU’s dependence on totalitarian regimes for its energy fuels. Since 2005, the bloc has imported €286 billion form tyrannies and aristocracies, with Russia being the largest source of natural gas for the past 15 years.

The fact sheet examined NG imports from within and outside the European Union from Not Free, Partly Free, and Free countries between 2005 and 2019.

Germany is one the world’s largest natural gas importers. Data from Rystad Energy shows that in 2019, the country shipped in 55.5 billion cubic meters of gas from Russia, 27 bcm from Norway and 23.4 bcm from the Netherlands.

So much for Germany’s “energiewende” (energy transition).

What’s wrong with importing gas from Russia? The report notes that Russia has a history of interrupting natural gas flows for political gain:

This ever-growing dependence on Russia makes the EU potentially vulnerable to natural gas supply disruptions that could result from geo-political events, such as Russian meddling in the former Soviet Bloc countries. In the past, Russia has punished European countries that were selling Russian gas to Ukraine by cutting off natural gas being delivered through both Nord Stream and an existing pipeline to the Ukraine.

Other highlights from the report:

Of the over €286 billion worth of natural gas imported by the EU from Not Free countries between 2005 and 2019, almost €165.3 billion worth, or nearly 58%, came from Russia; over €89.1 billion worth, or 31.1%, came from Algeria.

Of the €16.4 billion worth of natural gas that the EU imported from Not Free countries in 2019, nearly €16.3 billion worth, or 99%, was imported from just three countries — Russia, Algeria, and Libya (see Figure 2b).

Sources: Canadian Energy Centre, Eurostat, Freedom House

Of the €16.4 billion worth of natural gas that the EU imported from Not Free countries in 2019, Italy, Spain, Hungary, Greece, and Slovakia alone imported over €14.8 billion from tyrannies and autocracies. Italy imported the most at nearly €9.3 billion or 56%.

The EU and Turkey are heavily reliant on Russia for natural gas: 77% of natural gas exports from Russia’s majority state-owned Gazprom go to the EU. Germany used the most gas at 57 bcm followed by Italy at just over 22 bcm.

For at least 15 years the EU has been heavily dependent on the natural gas shipped to it from autocracies and tyrannies, most notably Russia. With the planned completion of Gazprom’s Nord Stream 2, natural gas imports to the EU from Russia will only grow, making the EU even more vulnerable to Russian influence.

Australia

Australia’s fuel security is more precarious than most Australians probably realize. According to The Conversation, not only does the country not have the internationally mandated 90-day stockpile, but ongoing refinery closures put it on track to being 100% reliant on imported petroleum by 2030.

These refineries import around 83% of the crude oil they process, with the lion’s share coming from Asia (40%), followed by Africa at 18% and the Middle East at 17%.

The article notes that ongoing tensions in the South China Sea threaten a major supply route for Australian oil imports, the disruption of which would have consequences within days for our food supplies, medication stocks, and military capacity.

The vulnerability of Australia’s supply lines through Indonesia has also been documented. In 2014, Al Qaeda-aligned militants tried to hijack a Pakistani frigate and use it to target US Navy vessels in the Indian Ocean. The terrorist group reportedly urged jihadists to attack oil tankers in two maritime hot spots that supply Australia with up to 70% of its gasoline.

Japan

Japan’s relative isolation and its lack of natural resources made it the fifth-largest oil consumer and fourth-largest crude oil importer in 2019. The country has no international oil or natural gas pipelines, and therefore relies exclusively on tanker shipments of LNG and crude oil.

Before the 2011 earthquake/tsunami and partial meltdown at Fukushima, Japan was the world’s third largest nuclear power user, behind only the US and France. Prior to 2011, nuclear accounted for 13% of total energy needs, but the closure of all of Japan’s nuclear facilities for safety reasons and testing (some have re-opened) meant that by 2019, nuclear’s share had dropped to 3%.

According to the EIA, coal continues to command a significant share, 26%, of Japan’s total energy consumption, although natural gas is the preferred choice of fuel to replace nuclear.

In 2020, Japan’s largest crude oil importer was Saudi Arabia, and in 2019, the country consumed around 173 million tonnes of oil, with the largest amount coming from OPEC member states in the Middle East, according to Statista.

Conclusion

At the end of the day we have to ask, “Is going green really worth it?” To determine that, we first need to check whether mining all of the metals required for electrification and decarbonization is actually green. Chinese rare earths, Indonesian nickel, Congolese cobalt, are anything but.

For many years the United States and its allies bought their oil and gas from Saudi Arabia and other Gulf states. In recent years that dependence has eased.

At AOTH we’ve been warning for a decade the dangers of relying on fracking for anything but short term energy dependence. “The decline rate of shale gas wells is very steep. A year after coming on-stream production can drop to 20-40 percent of the original level. If the best prospects were developed first, and they were, subsequent drilling will take place on increasingly less favourable prospects.”

“My thesis is that the importance of shale gas has been grossly overstated; the U.S. has nowhere close to a 100-year supply. This myth has been perpetuated by self-interested industry, media and politicians. Their mantra is that exploiting shale gas resources will promote untold economic growth, new jobs and lead us toward energy independence.“ Bill Powers, author ‘Cold, Hungry and in the Dark: Exploding the Natural Gas Supply Myth’ in a Energy Report interview.

“Each year, the U.S. Energy Information Administration (EIA) forecasts production from the nation’s tight oil and gas plays — the hydrocarbon-rich formations targeted by the U.S. fracking industry. And each year, the EIA predicts rosy prospects for the nation’s oil and gas output. David Hughes carefully peered through the EIA’s forecasts, basin by basin, comparing the agency’s assumptions against the real-world drilling data that showed faltering productivity and fast declines from many shale wells. And he concluded that the EIA’s long-term oil and gas outlook suffers from an optimism bias so extreme that it borders on fibbing.”New Report Throws Doubt on Overly Optimistic Fracking Forecasts From U.S. Government,Clark Williams-Derry

But many Western nations remain under the thumb of oil oligarchs or sultans. Take Germany, which consumes the most natural gas of any EU country, the majority of which comes from Russia. 77% of natural gas exports from Russia’s Gazprom go to the EU. Of the over €286 billion worth of natural gas imported by the EU from Not Free countries between 2005 and 2019, almost €165.3 billion worth, or nearly 58%, came from Russia.

In a world that still runs on oil, how free are Western nations, when they depend on the good graces of places like Russia, Algeria and Saudi Arabia, for their oil and gas?

How free is the West when it must go cap and hand to China, for the new electrification/ decarbonization metals?

Consider: China rules the electric vehicle supply chain. It is also a major player in renewable energy markets (solar & wind), and is building the most new nuclear power plants of any country.

In the rush to electrify/ decarbonize, is the West not just substituting one energy tyrant for another? The world’s largest consumer of commodities already has a monopoly on rare earths mining/ processing, produces the most lithium and cobalt, and dominates the graphite market.

China controls about 85% of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral.

Beijing also appears to be locking up nickel supply, through investments in the leading producer, Indonesia. China is working with Indonesia to develop a huge facility for developing battery-grade nickel.

According to the International Energy Agency, China processes about 90% of the world’s rare earth elements, along with 50 to 70% of lithium and cobalt.

The United States is 100% import-reliant on 13 of the 35 critical minerals the Department of the Interior has classified. They include manganese, graphite and rare earths. According to Market Intelligence data, the majority of critical minerals imported during the second quarter of 2021 came from South Africa (41.4%), with 7.9% shipped from China.

“We are dependent upon different countries, most notably China, for a number of our critical mineral resources,” S&P Global quotes Abigail Wulf, director of critical minerals strategy for Securing America’s Future Energy, a group advocating for greater US energy independence.

Source: S&P Global

As China’s fist tightens on the mining of critical and green economy metals, Western politicians like Justin Trudeau, Joe Biden and Germany’s (ex-Chancellor) Angela Merkel have supported green energy/ transportation at the expense of fossil fuels.

Germany is phasing out nuclear and coal-fired plants but has not yet achieved the renewable power capacity needed to replace shuttered power-generation facilities.

It needs Russian natural gas just to keep the lights on and buildings heated. The recent decision to shutter three of its six nuclear power plants in the middle of winter is foolish and cruel. What of the millions of Germans, and other Europeans unable to afford a quadrupling of power bills, that are being left in the dark to freeze?

Think about it. Without a workable plan to transition from fossil fuels to renewables, one that does not involve natural gas shipments from Russia, burning coal, or buying petroleum products from Saudi Arabia (like Canada and Japan), and without a concerted push to mine and explore for minerals within its own borders, the West is literally giving away its energy security to two countries: China and Russia.

They must be laughing at our stupidity.

(By Richard Mills)