The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition

As the world gears up for net zero, demand for raw materials is set to soar. The energy transition presents unique challenges for metals and mining companies, which will need to innovate and rebuild their growth agenda.

The transition to a net-zero economy will be metal-intensive. As the move toward cleaner technologies progresses, the metals and mining sector will be put to the test: it will need to provide the vast quantities of raw materials required for the energy transition. Because metals and mining is a long lead-time, highly capital-intensive sector, price fly-ups and bottlenecks will be unavoidable as demand outstrips supply and price volatility creates uncertainty around the large up-front capital investments needed for production. Supply, demand, and pricing interplays will emerge across different commodities, leading to feedback loops followed by a combination of technology shifts, demand destruction, and materials substitution. Metals and mining companies will be expected to grow faster—and more cleanly—than ever before. At the same time, end-user sectors will need to factor potential resource constraints into technology development and growth plans.

-

This article is a collaborative effort by Marcelo Azevedo, Magdalena Baczynska, Patricia Bingoto, Greg Callaway, Ken Hoffman, and Oliver Ramsbottom, representing views from McKinsey’s Metals & Mining Practice.

By the end of the November 2021 United Nations Climate Change Conference (COP26), it became clear that momentum had shifted. Climate commitments made in Glasgow have entrenched the net-zero target of reducing global carbon emissions (aimed at preventing the planet from warming by more than 1.5°C) as a core principle for business. At the same time, another reality became apparent: net-zero commitments are outpacing the formation of supply chains, market mechanisms, financing models, and other solutions and structures needed to smooth the world’s decarbonization pathway. Even as debate continues over whether the conference achieved enough, it is evident that the coming decade will be decisive for decarbonizing the economy. While every sector in the global economy faces common pressures—such as stakeholder and investor demands to decarbonize their own operations—metals and mining companies have been presented with a special challenge of their own: supplying the critical inputs needed to drive the massive technological transition ahead.

Raw materials will be at the center of decarbonization efforts and electrification of the economy as we move from fossil fuels to wind and solar power generation, battery- and fuel-cell-based electric vehicles (EVs), and hydrogen production. Just as there are several possible trajectories through which the global economy can achieve its target of limiting warming to 1.5°C, there are corresponding technology mixes involving different raw-materials combinations that bring their own respective implications. No matter which decarbonization pathway we follow, there will be fundamental demand shifts—and these will change the metals and mining sector as we know it, creating new sources of value while shrinking others.

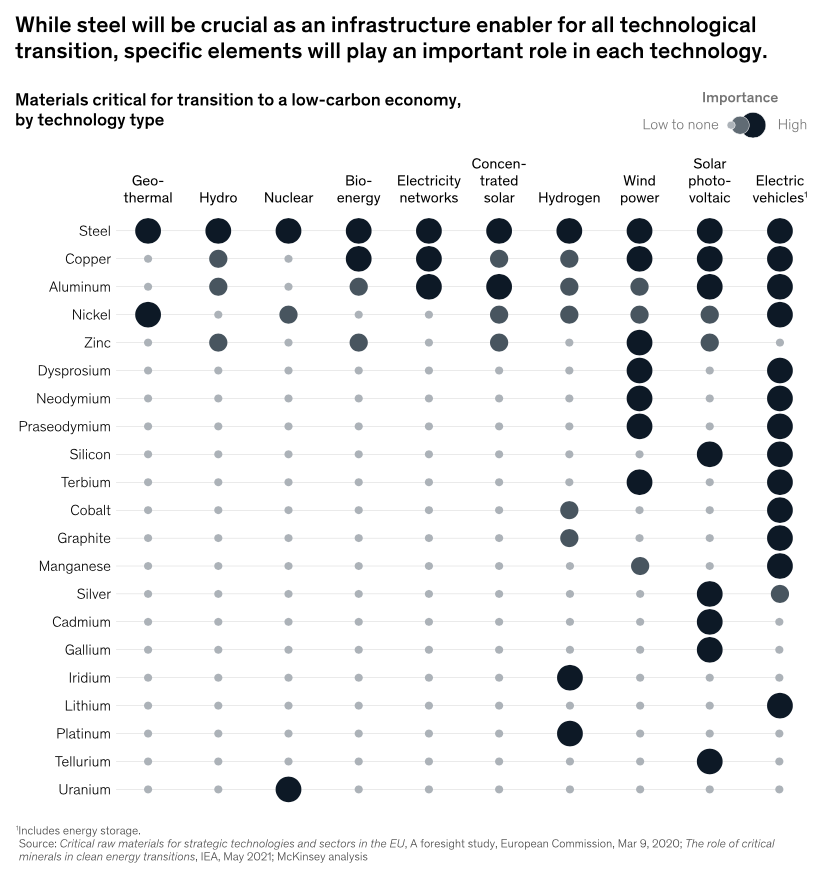

Requirements for additional supply will come not only from relatively large-volume raw materials—for example, copper for electrification and nickel for battery EVs, which are expected to see significant demand growth beyond their current applications—but also from relatively niche commodities, such as lithium and cobalt for batteries, tellurium for solar panels, and neodymium for the permanent magnets used both in wind power generation and EVs (Exhibit 1). Some commodities—most notably, steel—will also play an enabling role across technologies requiring additional infrastructure.

Exhibit 1

-

Rare-earth metals’ existing global reserves (in aggregate across different metals) are believed to be 120 million metric tons of rare-earth-oxide (REO) equivalent, representing 500 years equivalent of the global estimated production of 240,000 metric tons in 2020.1 However, when looking closer, a number of factors stand out. First, these elements occur in relatively low concentrations; therefore, identifying and bringing assets to production would likely come with higher investment needs and lead times. Second, specific elements (for example, neodymium), which are critical for the transition, occur at very different proportions within those deposits. This makes the availability and economics of specific metals much more nuanced than a superficial analysis can reveal. Third, there is a significant geographical concentration of known reserves: 40 percent of REO-equivalent reserves are estimated to be in China. Therefore, additional geological exploration would be needed to identify other economically viable deposits in specific geographies. Finally, in addition to the availability of raw materials, processing and separation of the specific elements is crucial. To date, most of the processing and separation capacity, as well as the technical capabilities, are also concentrated in China. Energy transition will therefore require a regional redistribution of processing capacity and reorganization of supply chains.

The required pace of transition means that the availability of certain raw materials will need to be scaled up within a relatively short time scale—and, in certain cases, at volumes ten times or more than the current market size—to prevent shortages and keep new-technology costs competitive (see sidebar “Rare-earth metals”).

Economic growth, technology development, and material intensity as drivers of demand growth

-

Tellurium, a relatively niche metal used in certain types of solar panels, has a global mine production of approximately 500 metric tons.1 A tellurium-only mine does not exist, as it is exclusively produced in small quantities as a by-product of the smelting and refining of other metals (more than 90 percent of tellurium is produced from anode slimes collected from electrolytic copper refining2 ). As such, while demand growth driven by solar capacity may be prodigious, growth in supply is expected to be capped at the growth rates of metals such as copper. Even though copper demand is also expected to experience significant growth due to the energy transition, its mine supply is unlikely to expand at the rates that solar-panel production needs in a net-zero-transition scenario.

Road-transport and power-generation are examples of sectors that are relatively advanced with respect to their technological readiness to reduce greenhouse-gas (GHG) emissions. But building a low-carbon economy and reducing the emissions intensity within these sectors will be materials-intensive (Exhibit 2). For example, generating one terawatt-hour1 of electricity from solar and wind could consume, respectively, 300 percent and 200 percent more metals2 than generating the same number of terawatt-hours from a gas-fired power plant, on a copper-equivalent basis,3 while still drastically reducing the emissions intensity of the sector—even when accounting for the emissions related to the materials production.4 (See sidebar “Mine supply and solar-panel production” for more on how supply of an essential raw material is currently limited.) Similarly, producing battery or fuel-cell EVs will be more materials-intensive than building an internal combustion engine (ICE) vehicle.

Exhibit 2

When building new power-generation capacity or producing new vehicles, factors other than material intensity also influence each technology’s carbon footprint.5 First, there are the emissions derived from use of the technology throughout its life cycle (such as the burning of fossil fuels in power generation, or the use of electricity in running a battery EV). Second, the emission intensity of each technology will depend, to a certain extent, on the choice of material (for example, steel versus aluminum in the case of vehicles). Third, even when using the same material, choice of supplier can make a significant difference, since the carbon footprint of the same commodity can vary greatly depending on its origin. Finally, each sector will have its own specificities. In the case of power generation, renewable capacity has lower capacity factors than fossil-fuel-based capacity. As such, more generation capacity and, hence, more metals are needed to generate the same amount of electricity. In the case of road transport, the average mileage of different powertrains could also play a role (for example, if battery EVs and fuel-cell EVs were to be driven for longer distances over their lifetimes compared with ICEs).

How quickly can supply react?

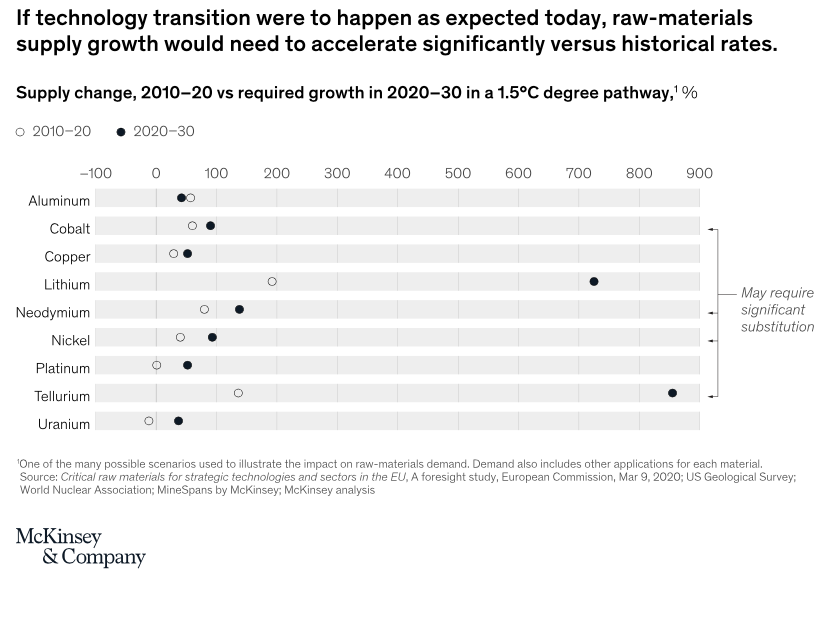

Looking ahead, under a scenario in which materials are required at steadily growing levels to meet evolving needs but markets fail to adapt to varying technology mixes6 and materials intensities over time, hypothetical shortages of raw materials would emerge—as demand is expected to grow significantly faster than supply. Under the scenario presented in Exhibit 3, lithium mine supply, for example, would need to grow by around a factor of seven versus today’s required growth. Meanwhile, metals with smaller mine supply (such as tellurium) would need to show even faster growth—as such, these are the main candidates for required substitution and technological innovation. Other metals, such as copper and nickel, would also need to see accelerated supply growth compared with what has been observed in the past. While the required growth in such metals may seem less ambitious, this should be considered relative to the significantly larger-scale industries surrounding them, as well as the significant capital required, increasingly challenging geological conditions (such as smaller deposits and lower grades), long lead times, and growing processing complexity involved. For copper and nickel alone, we estimate that meeting demand growth of the order of magnitude shown in Exhibit 3 would require $250 billion to $350 billion cumulative capital expenditures by 2030, both to grow and replace depletion of existing capacity. Despite a relatively large pipeline of projects to scale up supply in some of these commodities, and efforts to reduce the capital and operating costs associated with a number of them (such as direct lithium extraction), the task at hand is not trivial. In fact, in the scenario presented in Exhibit 3, we could see copper and nickel demand exceeding supply by five to eight million and 700,000 to one million metric tons, respectively. As such, incentives for new supply growth will be necessary.

Exhibit 3

Price incentives

-

Nickel, which is used in battery production, is widely available in the earth’s crust. However, it is subject to a number of commodity-specific factors. First, while battery-suitable nickel (that is, class 1 nickel) can be produced from the various deposit types (sulfides, laterites), relatively long lead times of ten years or more from discovery to feasibility, construction, and ramp-up, along with the high capital intensity of greenfield assets, could lead to short-term deficits. Second, nickel is a relatively established market, but it is primarily used in stainless-steel production (around two-thirds of the global nickel supply was used in stainless-steel production in 2020). The fast growth in nickel demand from batteries, therefore, may potentially lead to a fly-up in prices and require large-scale substitution and technological innovation to rebalance the market—either in batteries themselves, forcing a move to different battery chemistries, or in established markets such as stainless steel, driving a shift in stainless-steel-series production, or both—unless capacity starts to rise quickly, combined with conversion of lower-grade class 2 nickel into class 1 nickel.

Thus, while there may not necessarily be physical resource scarcity for some of these raw materials in the earth’s crust, and acknowledging that recycled materials will play an increasingly important role in decarbonization in the future, the trajectory toward materials availability will not be a linear one. We expect materials shortages, price fly-ups, and, given the inability of supply to react quickly, the need for technological innovation and substitution of certain metals (possibly at the expense of performance and cost of the end-use application). While raw-materials needs will grow exponentially for certain metals, lead times for large-scale new greenfield assets are long (seven to ten years) and will require significant capital investment before actual demand and price incentives are seen. At the same time, with increasingly complex (and largely lower-quality) deposits needed, miners will require significant incentive (for example, consistent copper prices of more than $8,000 to $10,000 per metric ton and nickel prices of more than $18,000 per metric ton) before large capital decisions are made (see sidebar “Nickel and battery production”). Without slack in the system (such as strategic stockpiles and overcapacity), the industry will not be able to absorb short-term (less than five to seven years) exponential growth. As seen, for example, with past reduction of cobalt intensity in batteries, a combination of technological development on the supply side and large-scale substitution and technological development on the demand side will occur. Substitution in noncritical applications will take place and new extraction and processing technologies will emerge. An individual sector’s ability to rapidly ramp up supply, as well as other factors such as continued technological development and performance, available material alternatives and carbon-footprint implications for end-use applications, to name a few, could all impact the extent of substitution for individual commodities. Hence, we see commodities such as tellurium, with its small volumes and by-product nature, likely requiring substitution, while lithium, despite the fast expected growth, perhaps not as much, given the relatively large pipeline of projects and continued development of new production technologies.

How market balance is achieved

Despite the potential for shortages, as discussed above, supply will always equal demand. As sectors and countries decarbonize, each individual commodity market will face specific supply-and-demand balances. The resulting picture will not mirror any specific forecasted commodity demand, including the scenario outlined in Exhibit 3, but what we will see is a constant feedback loop between supply, demand, and prices. We believe that commodities facing an upside in demand from the energy transition will follow one of three trajectories, as demand accelerates (Exhibit 4):

Supply responds to prices. As demand accelerates and prices react, the industry is able to bring in new supply (for example, lithium) relatively quickly. In such cases, the technological transition follows the “expected” growth, where the commodity does not become a structural bottleneck, even if there is short-term volatility.

Demand accelerates, prices react strongly, and materials substitution kicks in. The industry is unable to bring in new supply fast enough and technological innovation leads to materials substitution within that application (for instance, cobalt after a price spike). In such cases, performance of the technology deployed may be compromised, with implications for overall needs, for example, lithium iron phosphate (LFP) batteries being less energy dense than NMC7 batteries.

Demand accelerates, prices react strongly, and technology substitution kicks in. In this case, rather than materials substitution within the application, the end-user sector is forced to shift its technology mix. In such a scenario, a different bottleneck may emerge. For example, non-tellurium-based solar panels may have lower performance, which may lead to a shift toward more wind-generated power, adding pressure on neodymium.

Exhibit 4

We have observed the second trajectory within the battery sector, where there are three very distinct phases in the feedback loop. Initially, batteries with a relatively high cobalt content were common. As adoption began to accelerate, and cobalt prices reached $100,000 per metric ton in 2018, batteries with cathodes containing more nickel started gaining share. This substitution was in the end seen as a win–win result for the industry, leading to lower battery costs and higher energy density.

Subsequently, as high-nickel-containing batteries started becoming more common, the industry began to realize the scale of the task ahead: a large growth in class 1 nickel demand in an industry that has faced capital-expenditure overruns, delays, and in several cases, failure to reach design capacity. Nickel prices also started going up as consumers tried to secure supply.

Today, battery producers and OEMs speak about optionality, with a tiered approach to battery technology. LFP batteries have started gaining share again, while high-manganese-content batteries are also expected to be developed. Manganese is a compelling alternative, as its global production of approximately 20 million metric tons8 is four to five times greater than nickel production and 140 times greater than cobalt production. Meanwhile, manganese reserves of 1.3 billion metric tons are 16 times greater than reserves of nickel and 140 times greater than reserves of cobalt.9

This cycle is likely to keep evolving, as battery technology moves ahead, adoption accelerates, and possible new bottlenecks arise. And as other sectors make the energy transition, individual commodity sectors’ ability to ramp up quickly will be put to the test. With power generation, a similar cycle could follow, for example, with tellurium and silver potentially becoming a bottleneck for production of solar panels; with neodymium and praseodymium, for the rare-earth-based permanent magnets used in wind power generation; and potentially even with the extra uranium needed for additional nuclear-generation capacity.

Implications for producers and end-user sectors

The energy transition will force every sector of the economy to adapt, each with its own specific challenges.

As the raw-materials supplier to the economy, the mining sector will need to grow at an unprecedented pace in order to enable the required technological shifts. The sector will be expected to move at a faster pace, despite its traditional reputation as a long lead-time, highly capital-intensive industry. As metals will undoubtedly play a crucial role in keeping the planet within a 1.5°C warming scenario, producers of metals commodities will need to undertake the following:

(Re)build a growth agenda. In the context of shifting commodity value pools and rebalancing portfolios, the mining sector has underinvested for several years—an issue accentuated in 2020 by the COVID-19 pandemic. With the expected demand growth ahead, miners will need to rebuild their growth portfolios. This can take multiple forms, from grass-roots exploration to selective M&A and creating exposure to recycling. The sector’s financial health has improved significantly since 2015, with lowering debt-to-equity ratios and significant cash generation, although balance-sheet health will remain a key priority for most boards and executive teams, given the sectors’ cyclicality.

Innovate for productivity and decarbonization of operations. Technological innovation will be an important lever both to enable debottlenecking and growth (for example, advanced analytics in mining and processing) and to facilitate reduction of the carbon footprint in operations (for example, fleet electrification, water management).

Embed themselves into supply chains. Due to both the specific requirements of a number of decarbonizing technologies and the strict emission-footprint-reduction targets from end-user sectors, a number of metals will become less commoditized. Just as procurement by end-user sectors will change, so will the marketing and sales of metals. Understanding customers’ product specifications and requirements and partnering with consumers will be key, as will capturing quality and green premiums in the context of tightening supply–demand balances. In addition to placing volume on the market, this lever will help to manage downstream Scope 3 emissions from raw-material producers.

At the same time, consumers of raw materials will need to factor potential resource constraints into technology development and growth plans. The following solutions are on the table for consideration:

Adapt technology rollout plans. In response to raw-materials price volatility and supply constraints, companies will need to identify and distinguish between hard and soft constraints around technology rollout—and then engineer raw materials that may be difficult or expensive to source.

Send clear demand signals and secure raw-material supply. Clearly signaling growth, technology mix, and material needs will be an important mechanism to enable raw-material suppliers to approve large capital investments. This will take place (and is already doing so) in multiple forms: from off-take agreements with producers and partnerships with raw-materials suppliers to equity ownership of raw-material production. Irrespective of the strategy used, companies along the supply chain, such as cathode-active material producers, EV OEMs, and battery producers, will need to secure raw materials to enable aggressive growth plans, while also decarbonizing their own supply chains.

ABOUT THE AUTHOR(S)

Marcelo Azevedo is an associate partner in McKinsey’s London office, Magdalena Baczynska is a research science analyst in the Wroclaw office, Patricia Bingoto is a senior knowledge expert in the Zurich office, Greg Callaway is a consultant in the Johannesburg office, Ken Hoffman is a senior expert in the New York office, and Oliver Ramsbottom is a partner in the Hong Kong office.

The authors wish to thank Jochen Berbner, Nicolò Campagnol, Julian Conzade, Stephan Görner, Michael Guggenheimer, Benoît Petre, Humayun Tai, and Michel Van Hoey for their contributions to this article.