Headlines

‘A new industrial age’: The coming renewable-energy boom

Originally posted on Aljazeera.com

Steam rises from the coal-fired power plant near wind turbines in Niederaussem, Germany [File: Michael Probst/AP]

The world is at the “dawn of a new industrial age” of clean energy technology manufacturing that will triple in value by 2030 and create millions of jobs, according to the International Energy Agency (IEA).

The global market for key mass-manufactured technologies – including solar panels, wind turbines, electric vehicle batteries, heat pumps and electrolysers for hydrogen – will be worth about $650bn a year by the end of the decade, the IEA said in a report released on Thursday.

The figure is more than three times larger than current levels but is conditional on countries fully implementing their energy and climate pledges.

Related jobs in clean energy manufacturing will more than double from six million to nearly 14 million by 2030, and “further rapid industrial and employment growth is expected in the following decades as transitions progress,” the agency said.

“The energy world is at the dawn of a new industrial age – the age of clean energy technology manufacturing,” it said.

China has been dominating both the production and trade of “most clean energy technologies”, it added.

However, the Paris-based organisation warned the concentration of resource extraction and manufacturing posed risks to supply chains.

Three countries account for 70 percent of the manufacturing capacity for solar, wind, battery, electrolyser and heat pump technology, with China “dominant in all of them”.

Democratic Republic of the Congo produces more than 70 percent of the world’s cobalt, and three countries – Australia, Chile and China – account for more than 90 percent of the global production of lithium – a key resource for electric vehicle batteries.

‘Paying a heavy price’

Supply chain tensions have risked making the energy transition more difficult and expensive, the report added.

In a first, rising cobalt, lithium and nickel prices in 2022 led to an increase in the global price of electric vehicle batteries by almost 10 percent.

The cost of building wind turbines outside China has also crept up after years of declining prices, while similar trends are affecting solar panels.

The report said clean energy project developers and investors are watching closely for the policies that can give them a competitive edge. Government policies and market developments can have a significant effect on where the rest of these projects end up.

IEA executive director Fatih Birol urged countries to diversify supply chains, citing Europe’s dependence on Russian gas as a prime of example of the potential exposure to disruption caused by depending excessively on one trade source.

“As we have seen with Europe’s reliance on Russian gas, when you depend too much on one company, one country or one trade route – you risk paying a heavy price if there is disruption,” he said.

Birol also stressed the importance of international collaboration, “since no country is an energy island and energy transitions will be more costly and slow if countries do not work together.”

The IEA said in October that Russia’s invasion of Ukraine is likely to accelerate the world’s transition to greener energy from fossil fuels.

Energy security is “the biggest driver of renewable energies”, said Birol.

“Energy security concerns, climate commitments … industrial policies – the three of them coming together is a very powerful combination,” he said.

The world is entering a new age of clean technology manufacturing, and countries’ industrial strategies will be key to success

Originally posted on iea.org

Energy Technology Perspectives 2023 highlights major market and employment opportunities, as well as the emerging risks, for countries racing to lead the clean energy industries of today and tomorrow

The energy world is at the dawn of a new industrial age – the age of clean energy technology manufacturing – that is creating major new markets and millions of jobs but also raising new risks, prompting countries across the globe to devise industrial strategies to secure their place in the new global energy economy, according to a major new IEA report.

Energy Technology Perspectives 2023, the latest instalment in one of the IEA’s flagship series, serves as the world’s first global guidebook for the clean technology industries of the future. It provides a comprehensive analysis of global manufacturing of clean energy technologies today – such as solar panels, wind turbines, EV batteries, electrolysers for hydrogen and heat pumps – and their supply chains around the world, as well as mapping out how they are likely to evolve as the clean energy transition advances in the years ahead.

The analysis shows the global market for key mass-manufactured clean energy technologies will be worth around USD 650 billion a year by 2030 – more than three times today’s level – if countries worldwide fully implement their announced energy and climate pledges. The related clean energy manufacturing jobs would more than double from 6 million today to nearly 14 million by 2030 – and further rapid industrial and employment growth is expected in the following decades as transitions progress.

At the same time, the current supply chains of clean energy technologies present risks in the form of high geographic concentrations of resource mining and processing as well as technology manufacturing. For technologies like solar panels, wind, EV batteries, electrolysers and heat pumps, the three largest producer countries account for at least 70% of manufacturing capacity for each technology – with China dominant in all of them. Meanwhile, a great deal of the mining for critical minerals is concentrated in a small number of countries. For example, the Democratic Republic of Congo produces over 70% of the world’s cobalt, and just three countries – Australia, Chile and China – account for more than 90% of global lithium production.

The world is already seeing the risks of tight supply chains, which have pushed up clean energy technology prices in recent years, making countries’ clean energy transitions more difficult and costly. Increasing prices for cobalt, lithium and nickel led to the first ever rise in EV battery prices, which jumped by nearly 10% globally in 2022. The cost of wind turbines outside China has also been rising after years of declines, and similar trends can be seen in solar PV.

“The IEA highlighted almost two years ago that a new global energy economy was emerging rapidly. Today, it has become a central pillar of economic strategy and every country needs to identify how it can benefit from the opportunities and navigate the challenges. We’re talking about new clean energy technology markets worth hundreds of billions of dollars as well as millions of new jobs,” said IEA Executive Director Fatih Birol. “The encouraging news is the global project pipeline for clean energy technology manufacturing is large and growing. If everything announced as of today gets built, the investment flowing into manufacturing clean energy technologies would provide two-thirds of what is needed in a pathway to net zero emissions. The current momentum is moving us closer to meeting our international energy and climate goals – and there is almost certainly more to come.”

“At the same time, the world would benefit from more diversified clean technology supply chains,” Dr Birol added. “As we have seen with Europe’s reliance on Russian gas, when you depend too much on one company, one country or one trade route – you risk paying a heavy price if there is disruption. So, I’m pleased to see many economies around the world competing today to be leaders in the new energy economy and drive an expansion of clean technology manufacturing in the race to net zero. It’s important, though, that this competition is fair – and that there is a healthy degree of international collaboration, since no country is an energy island and energy transitions will be more costly and slow if countries do not work together.”

The report notes that major economies are acting to combine their climate, energy security and industrial policies into broader strategies for their economies. The Inflation Reduction Act in the United States is a clear example of this, but there is also the Fit for 55 package and REPowerEU plan in the European Union, Japan’s Green Transformation programme, and the Production Linked Incentive scheme in India that encourages manufacturing of solar PV and batteries – and China is working to meet and even exceed the goals of its latest Five-Year Plan.

Meanwhile, clean energy project developers and investors are watching closely for the policies that can give them a competitive edge. Relatively short lead times of around 1-3 years on average to bring manufacturing facilities online mean that the project pipeline can expand rapidly in an environment that is conducive to investment. Only 25% of the announced manufacturing projects globally for solar PV are under construction or beginning construction imminently, according to the report. The number is around 35% for EV batteries and less than 10% for electrolysers. Government policies and market developments can have a significant effect on where the rest of these projects end up.

Amid the regional ambitions for scaling up manufacturing, ETP-2023 underscores the important role of international trade in clean energy technology supply chains. It shows that nearly 60% of solar PV modules produced worldwide are traded across borders. Trade is also important for EV batteries and wind turbine components, despite their bulkiness, with China the main net exporter today.

The report also highlights the specific challenges related to the critical minerals needed for many clean energy technologies, noting the long lead times for developing new mines and the need for strong environmental, social and governance standards. Given the uneven geographic distribution of critical mineral resources, international collaboration and strategic partnerships will be crucial for ensuring security of supply.

Metals prices could spike with markets so tight, Trafigura says

Originally posted on Miningweekly.com

Trafigura CEO Jeremy Weir

Geopolitical shocks could trigger a surge in metals prices because the market has never been tighter, according to Trafigura Group.

“We could be pushed into extreme price levels,” Jeremy Weir, the commodity trader’s chief executive officer, said at a mining conference in Saudi Arabia. “We need to address this problem now. We are at a pretty critical stage.”

His comments come as mining executives warn that much more investment is needed to ensure the world has enough supplies of energy-transition metals in the next decade.

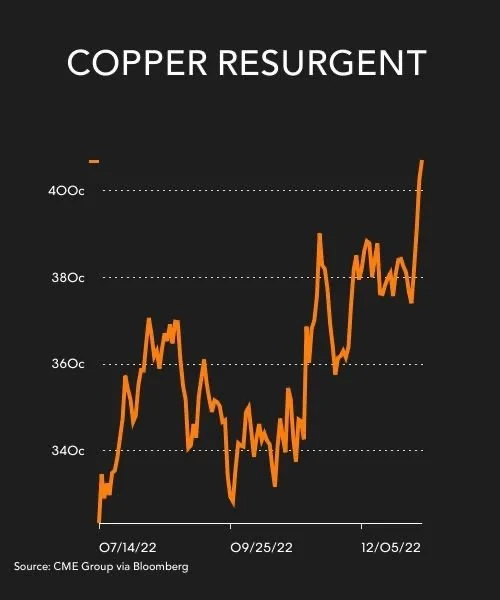

Copper, a key industrial metal, rose to $9 000 a ton on Wednesday for the first time since June.

Minerals such as copper, cobalt and nickel are crucial for electric-vehicle batteries, wind turbines and solar farms. Supply will have to rise hugely to meet demand, Dominic Barton, chair of Rio Tinto Plc, said at the same conference.

“We don’t have enough projects going on to get close to meeting that gap,” Barton said. “I worry about short-termism in an industry that’s long-term.”

Part of the problem is that mining is seen as a dirty industry even though it’s crucial to slowing climate change, Barton added.

“We need these minerals,” he said. “But the image, it’s a stone-age image.”

Molybdenum Market Forecast: Top Trends That Will Affect Molybdenum in 2023

Originally posted on Investingnews.com

After remaining relatively flat in the first half of 2022, molybdenum prices took an upward turn in the year's final quarter.

About 80 percent of the molybdenum that is mined each year is used to make stainless steel, cast iron and superalloys. Strong demand from China paired with supply constraints supported prices in the last month of the year.

With 2023 now in full swing, investors interested in the industrial metal are wondering about the molybdenum outlook for next year. Here the Investing News Network (INN) looks back at the main trends in the sector and what’s ahead for molybdenum.

How did molybdenum perform in 2022?

At the end of 2021, analysts were expecting demand uncertainty and declining supply to support molybdenum prices in 2022.

During Q1, the market was impacted by fresh COVID-19 measures in China, the metal's top producer and consumer. Molybdenum prices also stagnated due to a slowdown in Chinese steel production as the country curbed output to reduce emissions.

“China’s ambitious emissions targets are expected to further weigh on steel output ahead, taking a toll on molybdenum prices in turn,” FocusEconomics analysts said back in March. “Moreover, muted industrial production, pandemic-related uncertainty and fears over the health of China’s property market all cloud the outlook.”

The beginning of the second half of 2022 saw prices correct as the market was impacted by weaker demand and potential supply disruptions due to COVID-19 and the ongoing Russia-Ukraine war.

“China’s emissions targets will continue weighing on steel output, while global demand will cool due to a deteriorating economic panorama,” states a FocusEconomics report from July, when prices were averaging US$39,860 per metric ton (MT).

By August, prices had reached their lowest level, averaging around US$33,365. However, molybdenum took a turn in the last quarter, jumping over 50 percent between November and December. The metal ended the year trading above US$46,000.

In terms of supply and demand, the latest figures from the International Molybdenum Association show that the global molybdenum production came in at 142.4 million pounds in Q3 2022, a 1 percent decline compared to the previous quarter and a 2 percent fall compared to the third quarter of 2021.

Meanwhile, global use of molybdenum in Q3 2022 reached 160.4 million pounds, a 10 percent increase year-on-year.

What factors will move the molybdenum market in 2023?

It's important for molybdenum investors to remember that the market is driven by what happens in the steel and oil and gas sectors, with the latter being a traditional consumer of high-molybdenum steel for pipelines.

If demand is driven by steel and oil and gas, output on the other hand is dictated by what happens in copper, as more than 80 percent of molybdenum production comes from copper mines.

It should come as no surprise then that China is the world’s top molybdenum-producing country, putting out a total of 130,000 MT in 2021, according to the US Geological Survey. In a distant second place is Chile, which produced 51,000 MT that year and is the leading molybdenum-producing country in Latin America.

Even though these particular aspects of the molybdenum market make it difficult to make forecasts, there are some trends that the sector will continue to see moving forward.

“The molybdenum market is in a bit of a crisis at the moment,” Martin Jackson of CRU Group told INN. “Chinese demand has grown fairly strongly in the previous couple of years, but that investment pipeline has dwindled.”

In terms of supply, the analyst said mine output from the Americas is not expected to recover quickly, and several of the major by-product projects have seen delays in their commissioning.

All in all, CRU is expecting a demand deficit of 6 percent in 2023 based on flagging mine supply from the Americas and very strong demand from China. “We expected large price rises as a result, but the extent of this has still managed to surprise,” Jackson said.

According to CRU data, European and Asian oxide prices rose roughly 30 percent month-on-month in December, and prices are up over 20 percent since January 2022. “We’ve heard of cargoes struggling to find insurance, which is hurting availability,” Jackson said. “The last time prices were in this range was the first half of 2008.”

Meanwhile, FocusEconomics analysts see prices pulling back this year, but they should remain elevated by historical standards.

“The resilience of the global economy and the speed of the green energy transition are key factors to watch,” they said.

One trend investors should keep an eye out for is demand from the renewables sector. Molybdenum and copper are used in more than eight clean energy generation and storage technologies.

Molybdenum – securing a domestic supply of the vital but underappreciated mineral

Originally posted on Investorintel.com

Element 42 on the periodic table is Molybdenum (Mo), commonly referred to in the industry as the easier to pronounce moly. Most of the world’s moly production comes as a byproduct from copper or tungsten mining. Most people know it as a lubricant. The main use of moly is in steel production as it gives weather and acid resistance in certain steel alloys, particularly stainless steel. This is an element largely overlooked as current production is in the range of 290,000-300,000 metric tonnes per year, which makes it a $10 billion annual business at its current pricing of $16/lb. Pricing earlier this year reached $20 per pound. Those are prices that have not been seen since 2008. Two years ago, the price was under $8 per pound.

According to the CPM Group, there are 76 mines globally that produce moly and 36 are inside China, with China producing over 40% of the world’s output. Between 70-80% of that output is from copper mines. In 2021 the world’s top 10 moly producing countries were:

Outside China, there are only two pure moly plays, and both of these are in Colorado and operated by Freeport-McMoRan (NYSE: FCX) subsidiary Climax Molybdenum. 90% of western-sourced moly comes from copper production. This means that the main driver for moly production is copper production, so output and pricing can be counterintuitive. An example of this was in 2020 when prices dropped 30% but production went up, while in 2021 prices climbed 96% but production went down.

According to a World Bank report on the impact of low carbon technologies (LCT) in 2018, 21 million tonnes of copper were produced compared to 0.3 million tonnes of moly, or about 1 tonne of moly per 7,000 tonnes of copper. Moly is used in wind turbines, with one megawatt of output requiring 130 kilograms of moly. A typical offshore turbine is 12MW, which requires 1.56 tonnes of molybdenum.

One of the issues facing the industry is Chile’s production. According to CPM, moly production in 2021 dropped 7.5% from 2020. The main drop was from Codelco, a state owned Chilean company, whose production declined 24%. A presentation by Codelco in 2019 indicated they needed new investment, otherwise production would fall by 74% by 2029. The Chilean government has asked Codelco to find $1 billion in annual savings and make a $8 billion cut in planned investments. This may delay investments. The Chilean government is talking about privatizing the mining industry and taking a royalty of up to 12%. These steps will likely give companies pause for thought on new investments. Based on this, the CPM Group is looking at a deficit position for moly over the next five years.

There is one potential new moly mine opportunity that is intriguing – Stuhini Exploration Ltd. (TSXV: STU) based in British Columbia. The CEO, David O’Brien, pulls a monthly salary of $2,000 which is different than a lot of junior mining companies. The share structure is very tight with 26.1 million shares issued and fully diluted at 28.3 million shares. Insiders hold 43% and Eric Sprott is a strategic investor.

Stuhini’s project is in Northwestern British Columbia and is called Ruby Creek. It has an option to earn 100% interest with a 1% NSR. There is a $22 million road built by a previous operator so there is access to the site. The mine was under construction by Adanac Molybdenum Corp. when it went bankrupt because of the 2008 financial crisis. This is a pure moly play, like the two mines in Colorado. A resource was released earlier this year with a measured and indicated resource of 433 million pounds. This gives an in situ value of $6 billion at current prices. Additionally, there are gold and silver indications on the property. Interestingly the market cap is $14 million while the previous operator had a market cap of $300 million.

It bears keeping an eye on this moly as low carbon technologies expand and what decisions Chile makes over the next few years. At present pricing, it can support new mines but there are few stand-alone opportunities. It is well worth keeping an eye on this market.

By ALASTAIR NEILL

Tesla files for $776 mln expansion of Texas Gigafactory

Originally posted on Reuters.com

A view shows the Tesla logo on the hood of a car in Oslo, Norway November 10, 2022. REUTERS/Victoria Klesty

Tesla (TSLA.O) has applied to expand its gigafactory in Texas with an investment totaling $775.7 million, government filings showed, marking one of its largest expansion drives since setting up the $5.5 billion gigafactory in Germany last year.

It plans to add five new facilities at its Austin site, including a cell test lab and a unit named "Cathode", according to the company's filings on the Texas state department of licensing's website on Monday and Tuesday.

Tesla did not immediately respond to a Reuters request for comment.

The Austin expansion comes days after Reuters reported that Tesla promoted its China chief Tom Zhu to take direct oversight of the carmaker's U.S. assembly plants as well as sales operations in North America and Europe.

The world's most valuable automaker has been facing COVID-driven production and logistics snags at its key Shanghai hub, coupled with growing demand concerns.

Tesla's fourth-quarter deliveries fell short of market estimates. The company is also running a reduced production schedule at its Shanghai plant through January, extending the reduced output it began in December, Reuters has reported.

The company is expected to host its investor day on March 1 at the Austin facility and will likely disclose plans for expansion and capital allocation.

Tesla also has a gigafactory in Nevada, and a production facility in Fremont, California.

Local newspaper Reforma reported in December that Tesla could announce the construction of a gigafactory in the northern Mexican state of Nuevo Leon soon, with an initial investment of between $800 million and $1 billion.

Surging molybdenum price adds weight to new year rally for copper producers

Originally posted on Mining.com

Euhedral, hexagonal molybdenite on quartz, from Molly Hill mine, Quebec, Canada. The large crystal is 15mm across. Image: John Chapman, Creative Commons

Copper prices started the new year with a bang – touching fresh six-month highs on Tuesday. Copper for delivery in March touched $4.0795 per pound or just shy of $9,000 a tonne, bringing gains for the first week of 2023 to over 8%.

Measured from last year’s summer lows the bellwether metal is up nearly 30% on optimism over a post-covid recovery in China, which consumes more than half the world’s copper, and long-term demand growth spurred by the energy transition.

In a new note, BMO Capital Markets points out molybdenum has been one of the strongest base metal performers in the recent past with the latest spot assessments at ~$32 per pound or $70,500 per tonne – more than 50% higher than November-end levels.

Molybdenum is often produced as a byproduct of porphyry copper mines with global production worldwide of 300,000 tonnes primarily destined for the steel industry.

BMO says with demand conditions still relatively muted due to softness on global steel markets output, the price surge for molybdenum is mainly driven by supply issues:

“With the ongoing output challenges at Codelco, responsible for ~50% of Chilean molybdenum supply, Chilean output remains well below the five-year average, though November did mark a return to y/y growth.

“Meanwhile, Peru’s output is also down y/y, while other key primary producers such as China and the U.S. are also facing production headwinds.”

BMO says the the gains in molybdenum should help by-product credits at many copper operations, reducing headline costs and profits at producers.

Copper mining stocks on a tear

A revived copper price is boosting the sector’s top producers, led by Southern Copper Corp (NYSE:SCCO) which is up 18.8% so far in 2023. Southern Copper, headquartered in Mexico City, is the world’s fifth largest copper producer in terms of volume.

Freeport-McMoran (NYSE:FCX) traded up nearly 4% on Tuesday in heavy volumes of almost 9 million shares by early afternoon. The Phoenix-based company is the world’s second-largest copper producer after Chilean state company Codelco and is up 16.8% just in the past week.

Investors in London-listed Chilean producer Antofagasta (LON:ANTO) are enjoying double digit gains in 2023 as are those who took a bet on Poland’s KGHM (WSE:KGH), which has gained 17% in Warsaw this year.

Even First Quantum Minerals (TSE:FM), locked in a bitter dispute with Panama over government revenues from the Vancouver-based company’s 300,000 tonnes per annum copper mine, is up 9% in 2023 as investors bet on a swift resolution.

Zijin Mining (SHA:601899,HKG:2899), which at around 500,000 tonnes per annum is the world’s ninth largest copper producer, last year acquired the world’s largest primary molybdenum-only mine with annual output of 27,200 tonnes per year. Shares of rapidly-growing Zijin, which is also a significant precious metals producer, are up 8.3% in Shanghai year to date.

Investors look for green ways to cash in on battery metals boom

Originally posted on Financialpost.com

A worker displays nickel ore in a ferronickel smelter owned by state miner Aneka Tambang Tbk at Pomala district, Indonesia. PHOTO BY YUSUF AHMAD/REUTERS/FILE PHOTO

Tainted by decades of environmental disasters, shattered communities and ravenous water consumption, mining companies — including those that dig up battery metals — are not traditional darlings of the environmental, social and corporate governance (ESG) crowd.

Veteran mining executive Sir Mick Davis — who led the resources company Xstrata PLC until its merger with Glencore PLC in 2013 — knows this all too well. Now running Vision Blue Resources Ltd., a fund focused on clean-energy-related mineral and metal companies, he’s looking to ride a new wave in the sector as it seeks to up its game on sustainability while meeting huge demand for battery metals.

For decades, Davis said miners had sought a “social licence to operate” by cultivating relationships with communities and governments. Now, he said, they need to address customer and investor concerns about responsible practices in order to obtain a “social licence to market.”

Davis’s words reflect a wider shift in the resources sector, as investors seek to profit from demand for commodities used in the clean-tech sector, while minimizing exposure to environmental or human rights problems.

Rethinking natural resource sustainability

So far, the pressure on this front has come largely from electric carmakers led by Tesla Inc. They’ve been demanding evermore supply chain traceability to root out cobalt linked to child labour in the Democratic Republic of Congo, lithium linked to droughts in Chile or nickel extracted at the expense of Indonesia’s tropical forests.

Institutional investors have perked up to these issues, too. In recent months, S&P Global Ratings has fielded “increasing interest” from natural resource investors in sustainability-focused risk analysis of mining companies, Lynn Maxwell, who leads its commercial operations in Europe, the Middle East and Africa, said.

Mining-sector executives often complain that climate campaigners tend to lump them in the same bucket as oil and gas companies. Jamie Strauss, chief executive of London-based Digbee Ltd., a specialized ESG disclosure platform for the mining sector, said this sentiment seeped into the investment community too.“It’s a re-education frankly. I think the world has become disconnected from where a lot of these products come from,” he said. “We’re not going to get these battery metals if we don’t have mining.”

Digbee’s reports help private-equity groups such as Tembo Capital Management Ltd., Arch Emerging Markets Partners Ltd. and Orion Resource Partners (USA) LP decide whether to invest, he said. So far, it has assessed 25 individual mining projects and plans to have covered 40 by the end of March using dozens of industry disclosure standards for gold, copper, graphite, magnesium, nickel and even metallurgical coal.

The company provides recommendations that managers can use to improve a mine’s sustainability credentials, and gives what it says is a more forward-looking view of each project than the algorithms used by major ESG rating agencies to look at companies as a whole.

The world has become disconnected from where a lot of these products come from

JAMIE STRAUSS

Still, Strauss said, high-profile disasters have been a “blemish” on an industry now focused on causing “zero harm” (many in the industry say “minimizing harm” is a more realistic goal).

Globally, at least 28 thematic funds focus exclusively on battery technologies and metals, including 13 created in the past year, according to Morningstar Inc. data. Sustainability-focused equity funds are already a way of gaining exposure to the sector (in Europe more than 100 of these have at least five-per-cent exposure to the mining and metals sector).

Investors are trying to gain exposure to battery metal prices without the risk attached to individual mining projects. Element ETFs LLC, a natural resources-focused asset manager, launched an exchange-traded fund ETF with US$5 million seed funding tied to futures contracts for copper, lithium, nickel and cobalt in December.

But the nascent battery metal markets remain too illiquid for most big fund managers. And if they prove leery of the mining companies themselves, that could spell trouble for a sector that needs to spend hundreds of billions to boost the supply of copper, nickel and lithium.

Each of the battery metals presents unique sustainability challenges.

For example, a large proportion of the world’s lithium comes from mineral-rich brines in South America. Over decades, freshwater flows from the Andes into basins beneath salt flats, leaching lithium from surrounding rocks. Mining companies evaporate the brines to extract lithium, something that has been depleting local water supplies, according to some communities in Chile’s Atacama region.

Chilean mining leader Sociedad Quimica y Minera de Chile has contested those claims, but it has been rushing to strengthen its sustainability credentials. Last year, it promised a US$1.5-billion overhaul of its practices, which would enable it to halve its extraction of brine by 2030 while still boosting output.

But the controversy over water has added to the incentives to invest in production in the U.S., which could lead to more localized processes and lower transport-related emissions. In June, when President Joe Biden’s Inflation Reduction Act was still being debated, the world’s largest lithium producer by market capitalization, Albemarle Corp. said it planned to build a plant near its mine in North Carolina capable of processing 100,000 tonnes of lithium chemicals annually.

Similar initiatives in nickel, however, could be tricky. The pace of Chinese investment in Indonesian nickel reserves, which also rely on coal power for extraction and processing, is so overwhelming that projects with potentially lower emissions elsewhere could struggle to be economic, analysts said.

Across the industry, measures to reduce the carbon intensity of operations, and to make them safer and less water hungry, could ease tensions with local communities and activists, while signalling to investors that miners are starting to take ESG seriously.

But mining will remain a relatively polluting and carbon-intensive business for the foreseeable future. The rush to expand production of minerals for EVs and renewable energy plants means “increasing emissions in one sector to reduce emissions in another sector,” Seth Goldstein, chair of the electric vehicle committee at Morningstar, said. “It’s a net benefit but still a risk.”

As the world searches for safe, low-cost big batteries, an old Australian invention is getting new attention

Originally posted on Cosmomagazine.com

In late September, a new power station opened in Dalian, northeastern China.

It’s a big battery – but it doesn’t look much like one that Tesla would sell you. The station is filled with tanks and pumps, moving liquids filled with vanadium throughout the facility. The only lithium to be had is in the phones of the staff operating the plant.

It’s a “flow battery”: a 40-year-old Australian invention that is receiving renewed focus as our energy grids transition.

How flow batteries work

Flow batteries were first developed in the 1980s, by now-Emeritus Professor Maria Skyllas-Kazacos at the University of New South Wales.

“Most of the batteries that we use are enclosed systems,” says Associate Professor Alexey Glushenkov, a chemist and research lead in battery materials at the Australian National University’s Battery Storage and Grid Integration Program.

In conventional batteries, the metals and salts that react to make electricity are all held in the one unit: the anode supplies electrons into an external circuit on one side, and the cathode accepts them on the other.

This is called a reduction-oxidation, or redox, reaction.

Flow batteries use the same chemical principle – they’re also called redox flow batteries – but their physical structure is different.

“Flow batteries have a different system that consists of two parts,” explains Glushenkov.

Schematic of a redox flow battery. Credit: Weber, A.Z., Mench, M.M., Meyers, J.P. et al. Redox flow batteries: a review. J Appl Electrochem 41, 1137 (2011). https://doi.org/10.1007/s10800-011-0348-2

First there’s the reactor, hosting an anode and a cathode, where the electricity-generating reaction takes place. An analyte and a catholyte – two liquids – are pumped through this.

“The second part of a flow battery is actually tanks of these electrolytes,” says Glushenkov.

“You pump the two liquids through the reactor, and their oxidation state changes when they’re in contact with the electrodes.”

Electrons and ions are transferred between the analyte and the catholyte, and electricity flows. The batteries can be charged and discharged by pumping the electrolytes back and forth.

The most promising flow batteries have both their analytes and their catholytes filled with dissolved vanadium: specifically, V2+ and V3+ ions.

Providing when lithium doesn’t (and not providing when it does)

This liquid vanadium dodges three of lithium-ion batteries’ most pressing problems: price, safety, and longevity.

The price and safety of the batteries are better simply because they don’t have lithium in them – an energy-dense, but reactive and resource-strained material.

But the longevity is thanks to the vanadium itself.

“There’s no consumption or degradation at all of that solution, because you’re either in one form of vanadium or the other,” says Vincent Algar, managing director of resources company Australian Vanadium.

“So the nature of that vanadium flow battery is that it doesn’t consume any of its reagents – you’re not going to get any reactions taking place which might destroy the cell over time.”

Warranties on big lithium-ion batteries are around 15-20 years. Vanadium flow batteries could, theoretically, last indefinitely.

Matt Harper, chief commercial officer at vanadium battery manufacturer Invinity, says that their batteries are expected to last at least 25-30 years, based on the tests they’ve run and batteries that are still performing after five or six years.

While he’s confident in their data, “the only way to figure out the battery’s really going to last 30 years is to run it for 30 years,” he says.

“The only way to figure out the battery’s really going to last 30 years is to run it for 30 years.”

Matt Harper

So: what’s the catch?

“They have less energy density. Therefore, to build a comparative battery you need to make it very, very large,” says Glushenkov.

The Dalian vanadium flow battery station. Credit: DICP

The Dalian station boasts a current capacity of 100 MW/400 MWh, which will eventually be expanded to 200 MW/800 MWh. Australia’s biggest operating battery, lithium-ion and taking up about the same space, is 300 MW/450 MWh.

Flow batteries also can’t be superior in power – kilowatts – but they can do better in energy storage. – kilowatt-hours.

“Our fleet, our phones, our devices, are all going towards lithium-ion: that’s become a power problem,” says Algar.

“But when we talk about changing our grid, to be able to handle all the renewable energy that we’ve currently got coming into it, we need to think about energy storage.”

“When we talk about changing our grid, to be able to handle all the renewable energy that we’ve currently got coming into it, we need to think about energy storage.”

Vincent Algar

Over a longer period of time – say, a night instead of a few hours – vanadium flow batteries are cheaper grid additions.

“The crossover point is, we think, about six hours at the moment, where the economics of using vanadium is better than lithium,” says Algar.

“Lithium-ion batteries do a really good job at replacing the gas-powered generators that run for something like 500 hours a year,” says Harper.

“Whereas what we look at is using the combination of our batteries and renewable power to provide baseload power.”

The batteries getting built

In late November, energy company North Harbour Clean Energy announced plans to develop what will be Australia’s biggest flow battery, at a modest 4 MW/16 MWh, alongside a manufacturing line in Eastern Australia.

Invinity is further along the line, currently shipping a battery half the size to Yadlamalka, north of Port Augusta in South Australia.

Originally slated to be done by the end of 2021, the project was delayed after heritage assessments on the original site for the battery found a large number of Aboriginal artefacts.

Having found a new location, the project is now expected to be operational early next year. It will be a 2 MW/8 MWh addition to the grid.

“What we look at is using the combination of our batteries and renewable power to provide baseload power.”

Matt Harper

“The project that we’re building at Yadlamalka, I think, is a perfect example of where the technology fits well,” says Harper.

It’s a place with abundant solar energy, that could do with some more overnight storage – as is evident from Port Augusta’s revived solar thermal hopes.

“Remote microgrids are perfect for flow batteries of all scales,” says Algar.

“They’re not temperature sensitive, like lithium-ion batteries, so they can operate quite comfortably in hot conditions, which is a real benefit. And, obviously, they’re non-flammable.”

While China, with nearly half the world’s vanadium, is throwing its efforts behind huge plants, Australia’s first users of vanadium might be farms, mines, and small remote communities.

“Those are all run by diesel right now, yet we’ve got so much renewable resources in those places,” says Algar.

Australia’s first users of vanadium might be farms, mines, and small remote communities.

There’s mining revenue as well as utility to be had here too: Australia has around 18% of the world’s vanadium reserves, mostly in Western Australia – hence Australian Vanadium’s interests. The element is still, mostly, used in steel, but flow batteries are going to change things.

“There’s only a handful of primary vanadium mines in the world at the moment,” says Algar.

“There is going to be a restriction of supply unless some new mines get developed.”

Invinity, conversely, has partnered with wind turbine manufacturing giant Siemens Gamesa: their heightened storage makes flow batteries a better partner for wind projects, which are often much bigger energy generators than solar farms.

“The combination of solar power and batteries together has been a huge story over the last three or four years, but we’re just starting to see the combination of batteries plus wind,” says Harper.

Manganese Batteries Market May Face Deficit in 2024

Originally posted on Mining.com

An essential component of the steel-making process, manganese has played an increasing role in the battery market. (Stock Image)

The high-purity manganese market may face a deficit as early as 2024, according to people in the industry heard by MINING.COM.

An essential component of the steel-making process, manganese has played an increasing role in the battery market. The metal sulphate is an important stabilizing ingredient in the cathodes of batteries widely used in electric vehicles and electronics.

Volkswagen, Mercedes, Tesla, and GM are among the companies that have announced intentions to use high-purity manganese in their cars. A Chevy Bolt, for example, can contain over 24 kg of manganese.

“The reason nobody is talking about manganese is that it’s very cheap, and it’s taken for granted,” said Andrew Zemek, special adviser at CPM Group.

While the lithium price has skyrocketed over the last couple of years, passing $80,000 per tonne and other metals like cobalt and copper reached over $8,000 per tonne, manganese sulphate costs less than $1,000 per tonne in China.

But increasing demand from the EV industry and the subsequent deficit of high-purity manganese may impact the metal price in 18 or 24 months, according to Euro Manganese CEO Matt James.

“There’s been a build-out of manganese sulphate capacity in China and that has been enough to feed the current demands of the battery industry,” James told MINING.com. “But going forward, we’re going to see significant growth in both the European and North American battery industry. Both of those will require their own supply chains.”

“As the market looks to source locally, in North America because of the Inflation Reduction Act(IRA) or Europe because of geopolitics, when they start to look at the high-purity capacity in both of those regions, it is very very small,” James said.

“The Chinese price does not reflect a western price. The price today in Europe and North America commands a significant premium,” said James.

People in the industry estimate the price at $3,300 per tonne by 2027 — growing to $4,000 by 2031 for Europe and North America, considering the cost of freight from China and costs with green credentials.

Reliance on China

Over 92% of high-purity manganese sulphate conversion capacity is in China. Currently, only two plants outside of China are in production, one in Japan and the other in Belgium.

Vibrantz Technologies produces high-purity manganese in Belgium and sources its ore from South Africa, Gabon, and Brazil.

The other producer outside China is Nippon Denko in Japan, which also uses imported ore.

Combined, these two facilities produce around 5% of the global high-purity manganese sulphate.

“I don’t see a risk of shortage in the short term because so much capacity is being built in China,” said Aloys d’Harambure, executive director of the International Manganese Institute.

However, the market may have to adjust with the United States and Europe moving to build their own supply chain of battery materials.

“The environmental, social, and governance procedures in China are sometimes not as strict as in other, European and North American and, some African countries. The cost of high manganese sulphate that you see from China is not realistic from the rest of the industry,” said d’Harambure.

According to Sam Jaffe, VP of battery storage solutions for E Source, China can always “blow out” the North American and European competitors if it chooses to do so.

But that dynamic is changing.

“As we move to intracontinental supply chains, China remains a huge factor in the high-purity manganese market, but it’s not the single determinant of where those markets will move,” said Jaffe.

Piping Manganese

By 2031, North America is expected to require over 200Kt of high-purity manganese annually.

The continent, however, has no current high-purity manganese processing capacity to supply a large number of battery gigafactories and cathode plants under development.

South32 is developing the first new US manganese mine in decades. The company has allocated $55 million of capital expenditure to work on the Hermosa project in Arizona for the current fiscal year and expects to begin a pre-feasibility study before mid-2023.

In Europe, Euro Manganese is developing its Chvaletice Project in the Czech Republic, the only sizeable, classified resource of manganese in the European Union.

The project entails re-processing manganese deposits contained in waste (tailings) from a decommissioned mine that operated between 1951 and 1975.

The company plans to convert the carbonate to high-purity manganese metal and sulphate and send it to Euro Manganese’s planned processing facility in Quebec where it will be converted into a liquid sulphate. The site is adjacent to two proposed cathode plants allowing the liquid sulphate to be piped directly into the cathode production processes.

“Going forward, we’re going to see a European battery industry and a North American battery industry,” said Jaffe. “Both of those are growing at a tremendous pace and are gonna require their own supply chains, including a supply chain for manganese. And when you thinking about moving forward, I would talk about 10 years from now or over the next five years.”

Evolutionary Vanadium Redox Flow Batteries

Originally posted on www.storen.tech

StorEn has developed evolutionary vanadium flow batteries.

Incubated at the Clean Energy Business Incubator Program (CEBIP) within Stony Brook University in New York, we are building upon the strengths of vanadium flow batteries to revolutionize the world of residential and industrial energy storage. At StorEn, we strive to bring real proprietary innovation to Vanadium Flow Batteries capitalizing on years of demonstrated technical creativity and experience in the energy sector of our Technology Team.

Our batteries deliver superior performances at a lower cost, and fulfill market demand for more efficient and cost-effective energy storage. StorEn takes what vanadium batteries already promise – durability and sturdiness – and use extensive R&D to focus on improving the electrical efficiency of the stack, the energy density of the electrolyte, and the module. Through these processes, we create efficient, powerful, environmentally friendly batteries embedding our international patents.

Lithium is the #1 Choice for Most Energy Storage Systems - Could Vanadium Be a BetterAlternative?

Originally posted on Finance.yahoo.com

Tesla Inc. (NASDAQ: TSL) is a major player today in the battery market for both electric vehicles and stationary battery applications. Its lithium batteries have a solid presence in grid-scale battery storage where energy storage of up to 4 hours is possible.

Lithium-ion batteries have also become the battery of choice in small electronic devices such as laptops and cell phones and in electric vehicles recently, due to their ability to pack a lot of energy storage into a small, light battery. But Lithium batteries are known to have a very short operating life, and also have other issues such as rapid heat generation due to which they may not be the first choice for large utility-scale commercial purposes.

Among the latest technologies to emerge in the energy storage field is the vanadium redox battery, also known as the vanadium-flow battery, which reportedly has several advantages over lithium batteries, including that they are non-flammable, reusable over long periods of time, discharge 100% of the stored energy and can last for over 20 years without degradation.

The global focus is shifting towards renewable energy sources and the need for alternate solutions in the energy storage arena is crucial.

South Carolina-based StorEnTechnologies hopes to answer the call through its potentially disruptive vanadium flow battery technology. The company says that its products are long-lasting, 100% recyclable, safe, and offer an affordable energy storage option, at what it says is the lowest cost per cycle in the world – up to eight times lower than lithium-ion batteries.

The Advantages Of Vanadium Over Lithium

Although vanadium was initially discovered back in 1801, researchers have only recently started to realize the potential it could have in the manufacture of batteries, due to its tremendous stability and endurance.

Here’s a look at how Vanadium compares with Lithium.

Vanadium-based batteries have a long lifespan of over 20 years without capacity loss, whereas lithium batteries degrade rapidly. Unlike lithium batteries which last for just 300 to 500 charge/discharge cycles before they need to be replaced, vanadium redox flow batteries can last for well over 20,000 charge/discharge cycles. This makes them highly suitable for large-scale storage from renewable sources such as solar and wind when connected to an electricity grid.

Vanadium is non-flammable and can operate at any temperature. Lithium is known to be flammable and can catch fire at relatively lower temperatures.

Vanadium-based batteries can increase discharge cycling by simply increasing the size of scaling the electrolyte storage tanks. This is because vanadium batteries store energy in tanks while lithium batteries store energy in cells. As a result, a tank expansion is all that is needed to increase energy storage in vanadium batteries. Lithium battery users would need additional batteries to increase energy storage.

The cost of ownership for vanadium flow batteries is significantly lower. Lithium batteries will degrade if not managed well and will require replacements much faster than vanadium flow batteries.

Storing energy for the future is increasingly becoming important as power generation evolves. With the anxiety around lithium supply, and the scalability issues associated with lithium batteries, flow batteries could potentially be the future of energy storage.

According to StorEn, the vanadium flow battery industry is still evolving, and only just being commercialized. It has not yet been able to tap into the eventual scale benefits that would result in cost reductions. But once the industry begins to mature, there could be opportunities for investors to make sizable gains by choosing companies poised to succeed in the vanadium flow battery space.

StorEn has recently launched an equity crowdfunding offering through StartEngine Primary, LLC, and has raised over $600,000 so far.

If you wish to invest in the StorEn campaign click here.

The above article was originally published on Benzinga here.

StorEn Technologies, Inc. develops and sells energy storage solutions based on our proprietary vanadium flow battery technology.

Harvard Professor: Lithium Batteries are made from Slave Mines

Originally posted on Dailymail.co.uk

A general view of artisanal miners working at the Shabara artisanal mine near Kolwezi on October 12, 2022. Kara said he had never seen a mine where child labor and slavery weren't present

A Harvard professor and author stunned podcast host Joe Rogan by telling him that almost every lithium battery-powered tech device relied on today by the western world is powered by slavery in cobalt mines in the Congo.

Siddharth Kara, the author of the book Cobalt Red: How The Blood of The Congo Powers Our Lives, insists there is no such thing as 'clean cobalt' - the term given to describe ethically mined cobalt.

Appearing on Joe Rogan's podcast earlier this week, he told the Spotify host that in fact, almost every single device used today that relies on a lithium battery is powered by slavery.

To support his argument, he shared videos he took from mines in the Democratic Republic of Congo, which show hundreds if not thousands of miners digging by hand.

'Cobalt is in every single lithium, rechargeable battery manufactured in the world today.

'Every smartphone, every tablet, every laptop and crucially, every electric vehicle,' he said, relies on it.

We can’t function on a day-to-day basis without cobalt, and three-fourths of the supply is coming out of the Congo. And it’s being mined in appalling, heart-wrenching, dangerous conditions.

'By and large, the world doesn't know what's happening...I don’t think people are aware of how horrible it is,' he said.

Challenged by Rogan on the concept of 'clean cobalt', Kara shot back: 'It's all marketing.'

He insist he has 'never seen' a cobalt mine where child labor and slavery are not obviously present.

Kara says the mines are predominantly controlled by the Chinese.

In an op-ed for CNN last year, he described visiting one mine where a child told him how he'd dig for heterogenite, the primary source of cobalt, then sell it to 'buying houses' - which Kara described as being run by 'Chinese agents.'

Those agents sell the cobalt on to foreign mining companies.

'Just like that, cobalt gathered by a child in Congo enters the formal supply chain,' he wrote.

American companies like Tesla and Apple have in the past vowed to crack down on human rights abuses and slavery in the cobalt supply chain.

Elon Musk vowed to switch to a cobalt-free battery to power his electronic vehicles, and Apple has been credited by human rights watchdogs as leading the charge in anti-slavery charge in the industry.

The Biden administration also recently entered an agreement with Zambia and the DRC to rinse the supply chain of abuses.

The persisting problem, according to Kara, is the control over the market that the Chinese government has.

'Before anyone knew what was happening, [the] Chinese government [and] Chinese mining companies took control of almost all the big mines and the local population has been displaced,' he told Rogan.

Now, the African nations are under 'duress' from China to fulfill demand.

'They dig in absolutely subhuman, gut-wrenching conditions for a dollar a day, feeding cobalt up the supply chain into all the phones, all the tablets, and especially electric cars,' he said.

American companies like Telsa still shoulder some of the blame, he said.

'This is the bottom of the supply chain of your iPhone, of your Tesla, of your Samsung.'

Kara says the COVID-19 pandemic made matters worse by the more responsible foreign mines to close.

It put the artisanal miners - those who dig by hand - into overdrive, with no regulation, according to Kara.

He has offered to arrange trips to Congo for CEOs of companies that use lithium batteries to show them the damage first hand.

European Commission Announces A New Legislative Proposal: The Critical Raw Material Act

Originally posted on Saharaprospectors.wordpress.com

European Commission President Ursula von der Leyen announced a new legislative proposal, the Critical Raw Material Act, to tackle the evolving dependency on China when it comes to raw materials and ensure more resilient supply chains.

The new legislative proposal, the critical raw materials act, seeks to tackle the evolving dependency on China when it comes to raw materials and ensure more resilient supply chains.

The proposal was announced as part of von der Leyen’s annual State of the Union address on Wednesday (14 September).

Lithium and rare earths will soon be more important than oil and gas.

” von der Leyen said during her announcement.

While the Commission already noted on several occasions that it is working on a legislative proposal to boost autonomy and resilience in the area of raw materials, it is the first time that the main pillars of the new approach were outlined.

“We must avoid becoming dependent again, as we did with oil and gas. […] We will identify strategic projects all along the supply chain, from extraction to refining, from processing to recycling. And we will build up strategic reserves where supply is at risk. This is why today I am announcing a European raw materials act ” she added.

“The not-so-good news is – one country dominates the market.”

Ursula von der Leyen

Many of the raw materials that the European Commission deems critical are primarily mined in China. This holds especially true for rare earths, where the supply risk is considered by the Commission to be the highest.

Around 90 % of these rare earth metals are currently mined by China – rendering the EU largely dependent on the Asian giant regarding this essential resource.

“Lithium and rare earths will soon be more important than oil and gas,“ von der Leyen emphasised.

On the heels of the green energy transition, the demand for critical raw materials is expected to rise dramatically. According to the European Commission, demand will increase by 500% by 2030. The World Bank projections also indicate that global demand for critical metals will increase by a factor of five by 2050.

However, the new Critical Raw Material Act will not only deal with securing supplies. It also aims to lessen the dependency on China when it comes to refining raw materials.

Lithium Rush

A case in point is lithium , which is a key battery metal and thus essential for the green energy transition. While China accounts for only around 9% of the globally mined lithium, it refines 60% of battery grade concentrates needed to produce battery packs for the electric vehicle manufacturers, leaving the EU largely dependent on China even in areas where there are a multitude of suppliers of the raw material itself.

Need For New Mines

Africa is the new frontier for critical raw materials needed for the green energy transition and China is way ahead of the west in securing vital and huge prospects in Africa.

More than 300 new mines could need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries, according to a Benchmark minerals intelligence forecast.

At least 384 new mines for graphite, lithium, nickel and cobalt are required to meet demand by 2035, based on average mine sizes in each industry, according to Benchmark. Taking into account recycling of raw materials, the number is around 336 mines.

The data highlights the height of the raw material challenge facing global automakers as they look to scale up production of electric vehicles this decade. Demand for lithium ion batteries is set to grow six-fold by 2032, according to Benchmark.

Conclusion

The new European critical raw materials act may just be that wake up call Europe needs to catch up in the global lithium rush!