Battery Metals stocks set to wade into the coming supply demand crunch

Originally posted on Proactiveinvestors.com

To build a clean energy future, a wide range of minerals and metals are required.

From copper to nickel to graphite, lithium, manganese and vanadium, to name a few, so called battery minerals and metals will fuel the technology revolution.

And from electric vehicles to computer chips, medical equipment and much more, these commodities will be wide ranging in their usefulness.

In this article, we'll look at three battery metals and various companies in this space including graphite, manganese and vanadium.

In this article:

The EV market continues to grow

Global electric vehicle industry sales grew more than 50% from 2021 to 2022, making up a total of 14% of all new cars sold in the world.

China’s sales have eclipsed its 2025 target, while in Europe sales have increased by over 15% leading to 20% of all sales being EVs.

Australia lags behind, with only 3.8% of its total new vehicles sales made up of EVs.

These figures from The Global EV Outlook released by (International Energy Agency (IEA), an annual publication that identifies and discusses recent developments in electric mobility across the globe, combines historical analysis with projections to 2030 and examines key areas of interest such as electric vehicle and charging infrastructure deployment, battery demand, electricity consumption, oil displacement, greenhouse gas emissions and related policy developments, hint at bigger things to come.

“Electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging – and they are bringing about a historic transformation of the car manufacturing industry worldwide,” said IEA executive director Fatih Birol.

You can view the IEA’s EV outlook below:

However, growing demand means more supply of critical metals, and that's where we could be heading for problems in supply.

Demand supply crunch looming

The rising uptake of EVs means more demand for the commodities that help build them.

Graphite for example is one of the key requirements for EVs, however up to 90% of battery-grade graphite is produced in one country — China.

That’s problematic given the number of EVs China is now producing and selling.

In a special report by Gulf News, it stated “It turns out that — as the demand for EVs increases — battery-grade graphite has become a scarce resource that manufacturers are running into problems with.

“Due to tough licensing rules for new mines, and despite the high demand for EVs, global graphite production actually shrank in 2020, to 954,000 tonnes, a 14% drop from 2019, according to an industry report.”

With that in mind, consider that Benchmark Minerals suggests an 18% year-on-year increase in demand to 2030.

According to energy and commodities consultancy Wood Mackenzie, unless mining licences are eased, research into synthetic graphite bears fruit, or a new battery chemistry with less need for graphite is found, the EV industry won't accelerate.

Note that Turkey has the largest reserves of graphite and that country, China and Brazil account for 72% of reserves.

Shortages won’t just be limited to graphite or lithium.

“The exponential growth from the electric vehicle sector has driven up demand for raw materials. Various widely-used lithium-ion batteries — from lithium iron phosphate (LFP) to nickel cobalt manganese (NCM) cathodes (positive) — use graphite anodes (negative),” Gulf News reports.

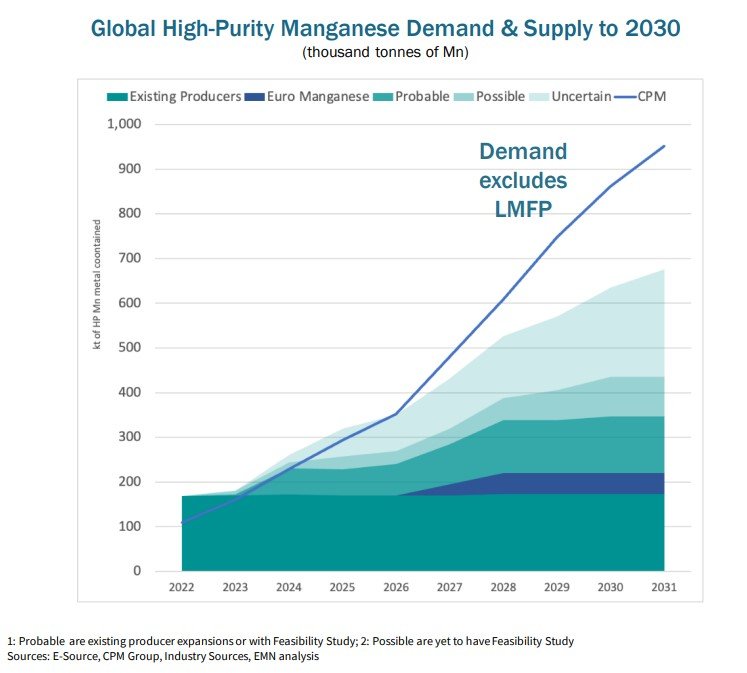

While Manganese is primarily used for steel, its use is growing in EVs and electronics.

Volkswagen, Mercedes, Tesla and GM intend to use high-purity manganese in their cars: a Chevy Bolt can contain over 24 kilograms of manganese.

“The reason nobody is talking about manganese is that it’s very cheap, and it’s taken for granted,” said Andrew Zemek, special adviser at CPM Group.

Manganese sulphate costs less than $1,000 per ton in China compared with $80,000 per ton for cobalt and $8000 per ton for copper.

A deficit of high-purity manganese is likely to drive the price higher.

“There’s been a build-out of manganese sulphate capacity in China and that has been enough to feed the current demands of the battery industry,” Euro Manganese CEO Matt James told MINING.com. “But going forward, we’re going to see significant growth in both the European and North American battery industry. Both of those will require their own supply chains.

“As the market looks to source locally, in North America because of the Inflation Reduction Act (IRA) or Europe because of geopolitics, when they start to look at the high-purity capacity in both of those regions, it is very very small,” James said.

By 2031, North America is expected to require over 200Kt of high-purity manganese annually.

That’s a lot of manganese. Vanadium will be required as well.

According to Research and Markets, the global market for Vanadium Redox Battery estimated at US$237.5 million in the year 2022, is projected to reach a revised size of US$592.4 million by 2026, growing at a CAGR of 20.9% over the analysis period.

Redox flow batteries are used for all types of stationary energy storage tasks and due to higher lifetimes the result is the lowest levelised cost of energy storage.

They are widely used in the sensor components of some critical military equipment, including ammunitions and weapons.

Graphite, manganese and vanadium are keen to clean technology development and more supply will be required as the years progress.

There are several small caps such as International Graphite Ltd (ASX:IG6), Sovereign Metals Ltd, Volt Resources Ltd and Sarytogan Graphite Ltd aiming to be part of the supply/demand solution.

A look at battery metals sector activity in the last quarter

Evolution Mining

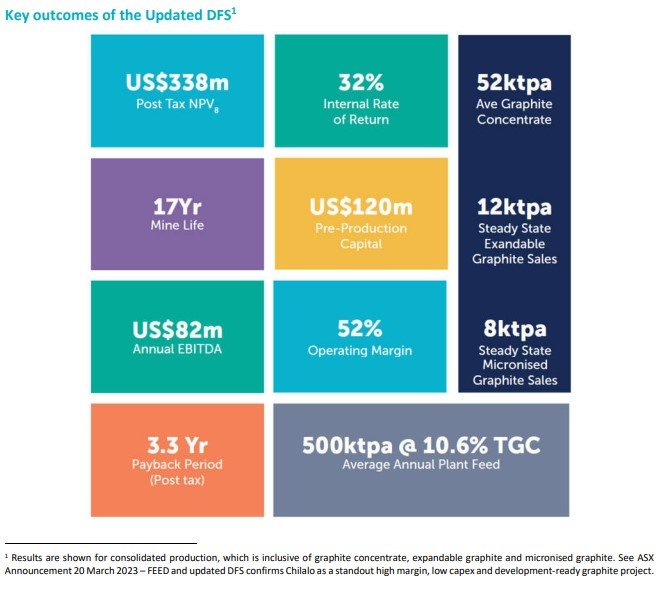

Graphite explorer Evolution Mining Ltd (ASX:EVN) hit two important milestones during the quarter that are fundamental to the development of the Chilalo Graphite Project: the updated definitive feasibility study and finalisation of the Framework and Shareholders Agreements with the Government of Tanzania.

The Updated DFS confirmed Chilalo is a high-margin, low-capex development option, poised to become a meaningful producer of high-value graphite products and take advantage of the looming graphite supply shortage.

The Framework Agreement governs the ownership structure, mineral rights, shareholder loans voting rights and operating framework for the project and is in line with other Framework Agreements signed by international companies. The Framework Agreement will be formally signed at a ceremony on Monday April 17, 2023.

“During the March quarter, we achieved a number of significant milestones for Chilalo with the release of the Updated DFS and settlement of the details of the Framework Agreement,” managing director of Evolution Energy Minerals Phil Hoskins said.

“Chilalo is a standout graphite development project, with further upside potential to be explored through a feasibility study into downstream processing into high-value graphite products.

“With these key milestones under our belt, we are fully focused on the financing of Chilalo in order to commence construction as soon as practicable.”

Evion Group

Evion Group NL (ASX:EVG) continued to advance its strategy to establish a graphite mine and battery anode material plant during the quarter.

It made significant progress in completing its Environment and Social Impact Study (ESIA) program for its Maniry graphite mine in Madagascar, which will underpin final mining licence approvals.

The company submitted the ESIA report to the Malagasy government to attain permits in the June quarter.

In January this year, Evion published its Scoping Study on its proposed Battery Anode Material (BAM) plant in Germany, finding the plant could generate strong financial returns.

Evion also made good progress at its Expandable Graphite JV site, confirming the Panthera Graphite project is on track for production in Q4 2023.

Finally, it signed a Collaborative Agreement with US company Urbix Inc. which is positioned to become one of the world’s largest producers of advanced, green battery anode material for the EV market.

The company has strong cash reserves of over $5 million.

First Graphene

First Graphene Ltd (ASX:FGR, OTCQB:FGPHF) also hit several milestones this quarter including:

circa 17% revenue growth on the same quarter last financial year and strengthened revenue pipeline to circa A$440,000;

one ton order of PureGRAPH® received for international concrete trial;

secured £89,000 grant to fund Research and Development of low-cost electrocatalyst;

received circa A$900,000 Research and Development tax credits;

strategic partnership and Joint Development Agreements signed with ATP India and Blue Snow Consulting respectively.

On the financial front, it reported a consecutive increase in revenue for the third quarter of FY2023, recording quarterly revenue of A$209,000 (unaudited), with revenue for the first three quarters of FY2023 increasing by approximately 40% compared to the same period last year.

FGR is further streamlining its cost base to better match its commercial vision. It has a clear plan to further reduce expenditure in the range of A$200,000 to A$250,000 per annum, which will be redeployed to further accelerate its commercialisation strategy.

Accelerate Resources

Manganese explorer Accelerate Resources Ltd (ASX:AX8), reported several highlights over the quarter.

Mapping confirmed the discovery of two large, mineralised manganese corridors in the central Woodie Woodie North Project and the company announced an aggressive Phase 3 drilling program which planned to commence in May 2023. Ground truthing and sampling programs for lithium mineralisation over larger untested areas also planned for the upcoming field season.

Other highlights include:

Heads of Agreement signed with US-based RedoxBlox Inc. represents first steps in AX8’s endeavours to integrate its business downstream to optimise the value of its critical minerals and proximity to major market;

achieved 99.9% High Purity Manganese Sulphate Monohydrate in initial test work program;

$2.5 million cash in hand as of quarter ending March 2023 with $450,000 received from the sale of Currie Rose shares post the March quarter.

Element 25

Element 25 Ltd (ASX:E25) has a lot going on across its Butcherbird Manganese operations and its High Purity Manganese Project.

Looking at the former, production was up 22% on last quarter to 62.2kt, with sales up 218% to 62.4kt helped by inventory destocking.

The company achieved a cashflow positive quarter, driven by improved production and sales.

It also installed a secondary feeder in February 2023, which has significantly debottlenecked front end feed rates in the processing plant resulting in an immediate and material throughput improvement. Improved March production was highlighted by the achievement of 24-hour record production of 1,859t, well above 1,000 tpd nameplate.

The cash margin per ton substantially increased at increased production rates following installation of the secondary feeder as unit cash costs reduced due to higher volumes.

The plant uptime campaign is now continuing to further improve plant availability through maintenance system enhancements.

HPMSM highlights include:

HPMSM Feasibility Studies in final stages of completion and peer review, due for release this month.

Activities for next quarter to include:

evaluation of engineering construction contractor proposals, permitting applications and site based surveys;

major packages early commencement of engineering design and awarding of front-end engineering design (FEED) contract; and

definitive agreements signed with global automaker Stellantis to supply of HPMSM for Stellantis’ EV battery requirements.

Note, E25 has a At-the-Market Subscription Agreement (ATM) with up to $30 million funding over three years as it continues development of its battery-grade high purity manganese sulphate (HPMSM) processing capabilities.

Australian Vanadium

Australian Vanadium Ltd (ASX:AVL) had a cash position of $23.2 million and no debt at March 31.

It said of its quarter, “The March quarter has seen strong progress in AVL’s journey to become a world class, vertically integrated ‘pit to battery’ vanadium producer.

“At all levels of the company the right team is being built to ensure that the Australian Vanadium Project is progressed in a technically robust and financeable manner.

From a financing perspective, the company is working to attract key investors such as RCF which has expanded its position on the register, working with HCF and Grant Thornton to pursue debt financing for the Project and pursuing avenues for project equity investment.

Strategic offtake partners are being progressed, with a focus on bankability of the counterparty.

Some of its highlights included:

successful Yugunga-Nya Native Title Aboriginal Corporation site visit undertaken and negotiations progressing;

Mineral Resource classification upgrade drilling results;

Wood appointed to undertake pyrometallurgical Early Contractor Involvement;

completion of Australian Government co-funded Co-operative Research Centres Project;

critical minerals collaboration signed with Neometals;

strategic bankable offtake partners being advanced;

increase in institutional investment, pursuit of export finance and project equity relationships progressing; and

vanadium electrolyte manufacturing facility site secured in Western Australia.

Richmond Vanadium Technology

Australian resources company Richmond Vanadium Technology Ltd (ASX:RVT) is advancing its 100% owned Richmond - Julia Creek Vanadium Project in North Queensland.

The company listed in December 2022, having raised $25 million before costs.

During the quarter it appointed specialist environmental consultant Epic Environmental to lead development of an Environmental Impact Statement (EIS) and assist with associated environmental approvals for the Richmond - Julia Creek Vanadium Project.

The Terms of Reference (TOR) for the EIS were finalised by the Queensland Government.

Further highlights include:

RVT and Ultra Power Systems (UPS) executed an agreement to form a joint alliance to grow vanadium redox flow battery manufacturing inclusive of an offtake arrangement;

experienced study manager Peter Hedley appointed as the Project Director for the Richmond – Julia Creek Vanadium Project Bankable Feasibility Study; and

the Richmond – Julia Creek Vanadium Project is capable of supporting a world class clean green focused vanadium operation for +100 years at current throughput rates, with a Mineral Resource of 1.8Bt @ 0.36% for 6.7Mt V2O5 and Ore Reserve of 459Mt @ 0.49% for 2.25Mt V2O5.

Surefire Resources

Exploration at Surefire Resources NL (ASX:SRN) 100% owned properties is ongoing including the Victory Bore Vanadium Project and Yidby Gold Project.

During the quarter the company increased its Mineral Resource Estimate for the Victory Bore Project by 56% to 321Mt @ 0.39% V2O5.

Importantly, an Exploration Target Estimate propels the Victory Bore project to World Class status with 682 Mt to 1,190 Mt @ 0.2% to 0.43% V2O5 with a Total of 1,003 Mt @ 0.2% to 0.39% V2O5 to 1,511 Mt @ 0.39% to 0.43 V2O5.

The High Purity Alumina (HPA) potential has been recognised at Victory Bore with up to 30% Al2O3 in the host rock.

To take it forward, the company appointed experienced managing director Paul Burton who has 30 years’ experience and was instrumental in resource discoveries and establishing a portfolio of quality exploration assets driving TNG Ltd (ASX:TNG), (now TiVan Ltd), to a market capital value of over $100 million and developing of the companies critical mineral Vanadium and battery mineral alternative energy strategies.

The company is buoyed by an extensive mineralisation and mineralising system emerging at the Yidby Gold project.

Technology Metals Australia

Advanced vanadium developer, Technology Metals Australia Limited received a Letter of Interest from Danish Export credit agency, EKF, with regards to potential funding support of around A$150 million for the Murchison Technology Metals Project (MTMP) this quarter.

The vanadium explorer also executed an MoU with fast growing Indian VRFB maker, Delectrik Systems Pvt. Ltd, for the potential sale of vanadium raw material from the MTMP as well as supply of vanadium electrolyte by vLYTE to Delectrik within Australia.

“We are entering a pivotal time in the vanadium market, with supply of vanadium to the traditional steel market under pressure from global VRFB deployments in parallel with a faster than expected rebound in demand from aeronautical applications. This demand side shift is happening at a time of geopolitical uncertainty, highlighting the significant supply chain advantages of developing a high-quality vanadium project in Australia,” TMT managing director, Ian Prentice said.

“As we progress the activities required to ensure the efficient and effective development of the long-life MTMP, we have seen significant interest from market participants for potential offtake of vanadium products and support for what will be the world’s next large-scale supplier of high purity vanadium. “The team is maintaining a clear focus on the timely progression of the development of the MTMP while ensuring that all our activities are in accordance with the company’s core mission and values consistent with our holistic ESG strategy.”

Other highlights included:

vanadium electrolyte plans progressing with production of high-quality battery grade vanadium electrolyte from MTMP feedstock;

GR Engineering and Iron Mine Contracting engaged as key project partners to work with TMT project team and FLSmidth to advance the Implementation Phase of the MTMP; and

positive momentum maintained on environmental approvals and Traditional Owner engagement consistent with the company’s ESG philosophy.